Hi Friends,

Hope every one doing well, i want to share one document for Employee Loans configuration. i know every one knows how to configure, please treat this document as a reference and give your valuable suggestions.

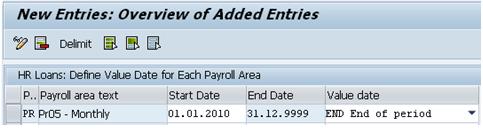

1. Adjust Value Date

Table no. V_T506S

Here, for your payroll area you have to define Value date

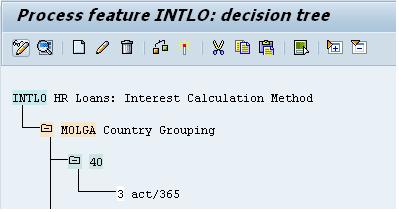

2. Specify Interest Calculation Method

Feature: INTLO

Here, you have to specify the Interest Calculation Method to your country grouping / respective groupings

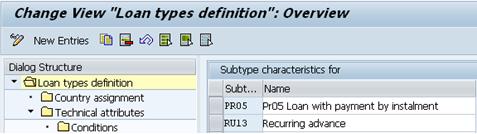

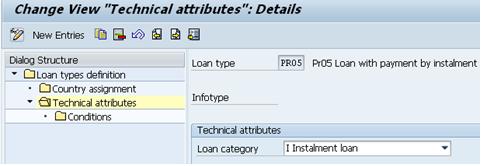

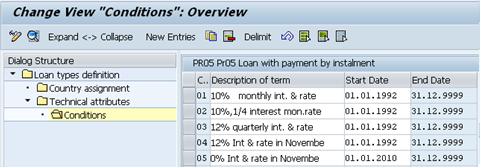

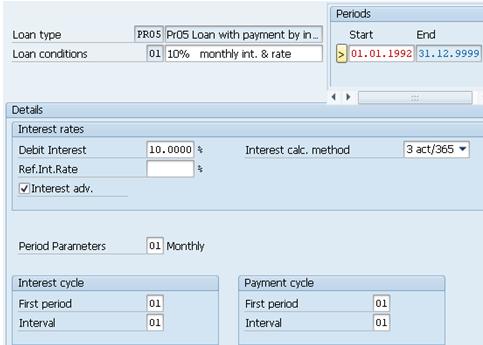

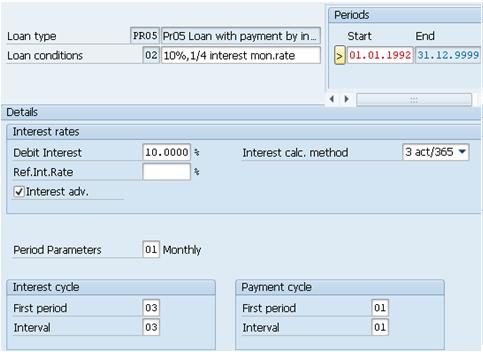

3. Maintain Loan Types

Table No. VV_T591A_4_VC506

Here, you have to maintain the Loan types and conditions for Interest calculations

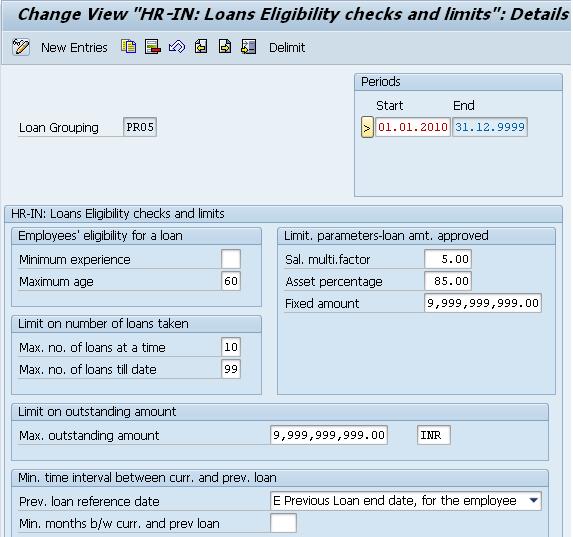

4. Maintain Loans Eligibility Checks and Limits

Table No. V_T7INJ3

Here, you have to maintain the Eligibility check for the loan types

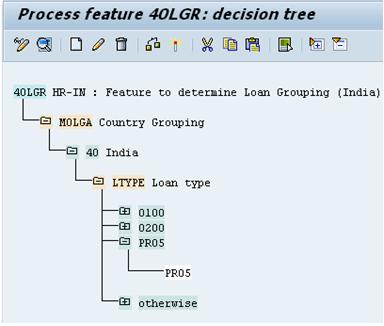

5. Maintain Loans Grouping

Feature: 40LGR

Here, you have to link the Loan eligibility to Loan Types

TESTING:

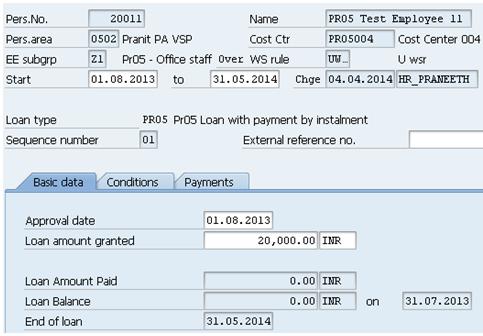

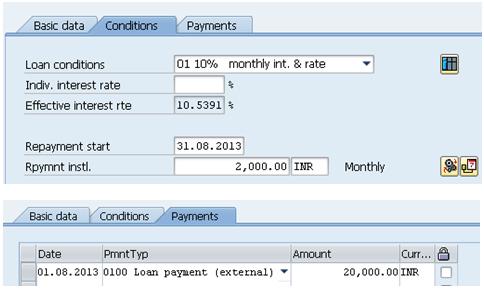

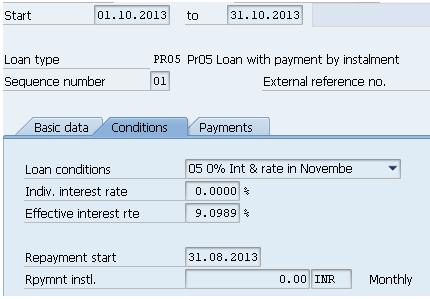

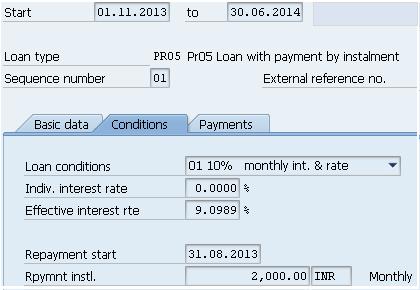

IT 0045 – Loans

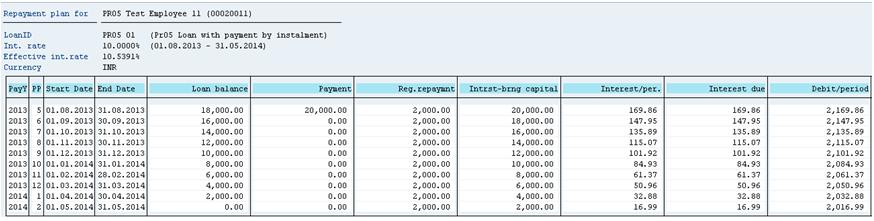

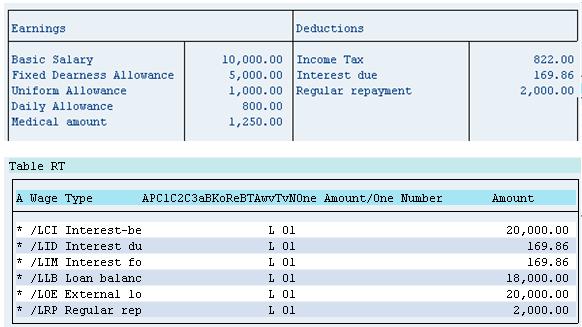

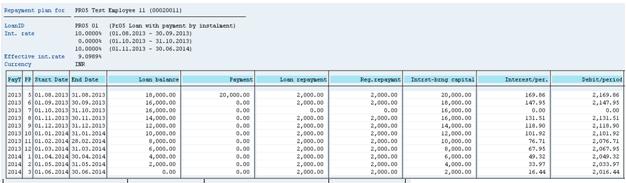

Repayment Plan:

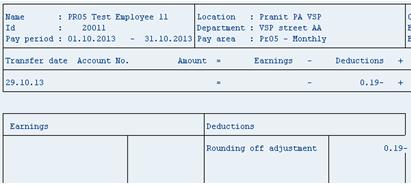

Salary Slip:

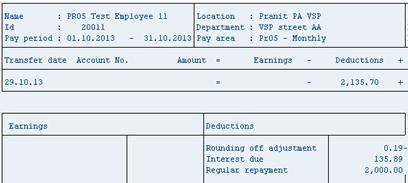

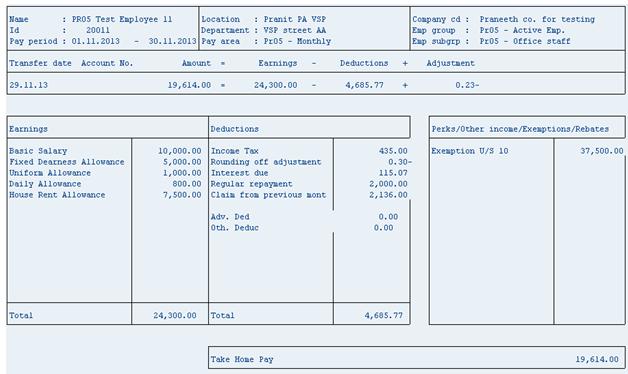

Scenario :1

1. When Employee in Full LOP for the Month.

solution:

The solution is depends on the Client Requirement, whether he want Carry forward the Deduction amount to the next payroll period or completely waved off the Regular Repayment and Interest too for the LOP and increase the Regular Repayment one month extra.

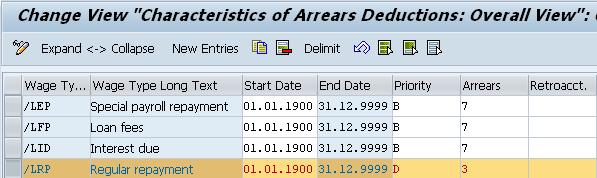

Carry forward scenario:

1. Need to change Wage type Arrears Characteristics table V_T51P6

No Deduction Scenario:

1. No need to change any Wage type arrears table.

2. Need to change loan type for installment for that particular period is 0.

3. Extend the Regular Repayment one month more or change the installment amount.

Thanks and Best Regards

Leave A Comment?

You must be logged in to post a comment.