Hi Friends,

I want to share the topic of Leave Encashment

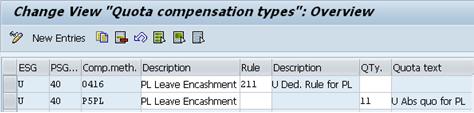

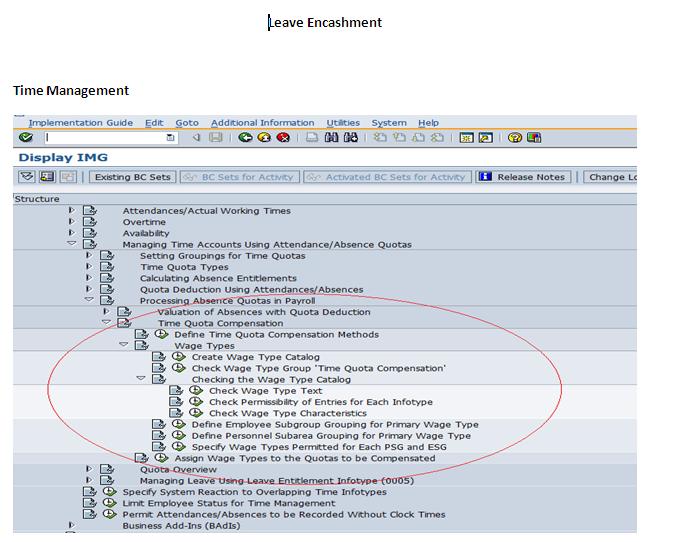

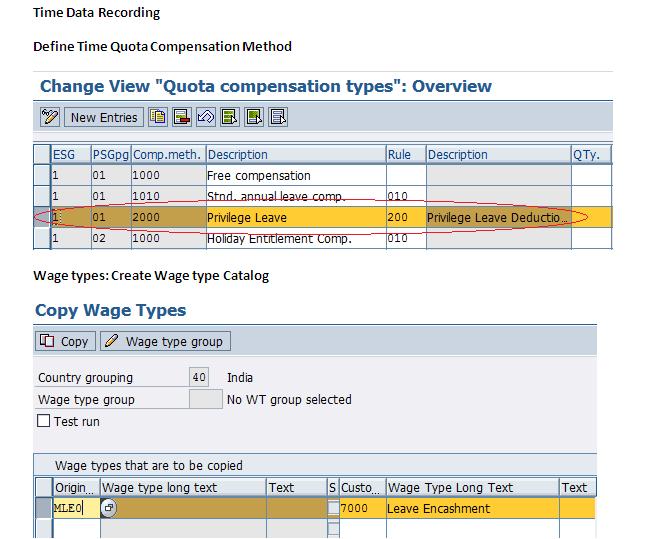

1. Quota Compensation types

Table no. V_T556U

Create Sub-types for Quota compensation types (IT 0416)

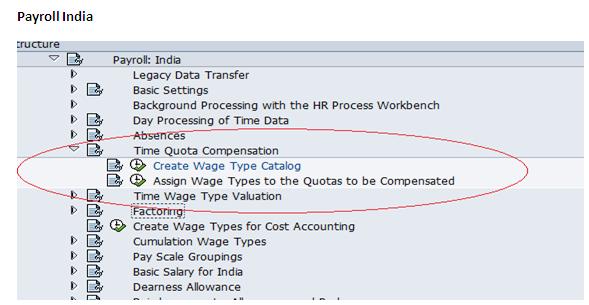

2. Create Wage Type Catalog

Table no. OH11

Create New WT, copy of std wt MLE0

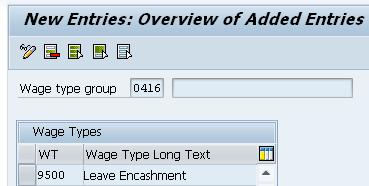

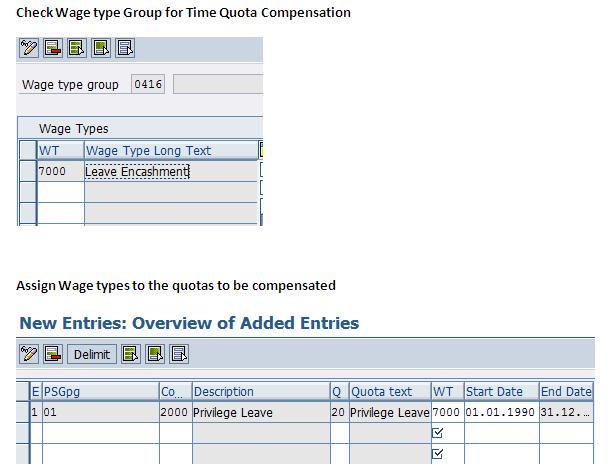

3. Check Wage Type Group ‘Time Quota Compensation’

Table no. VV_52D7_B_0416_AL0

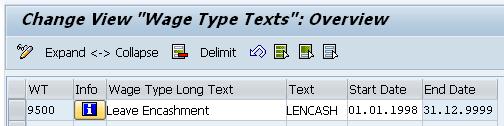

4. Check Wage Type Text

Table no. V_512W_T

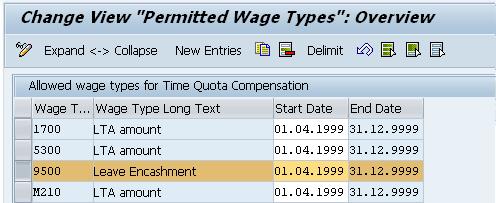

5. Check Permissibility of Entries for Each Infotype

Table no. V_T512Z

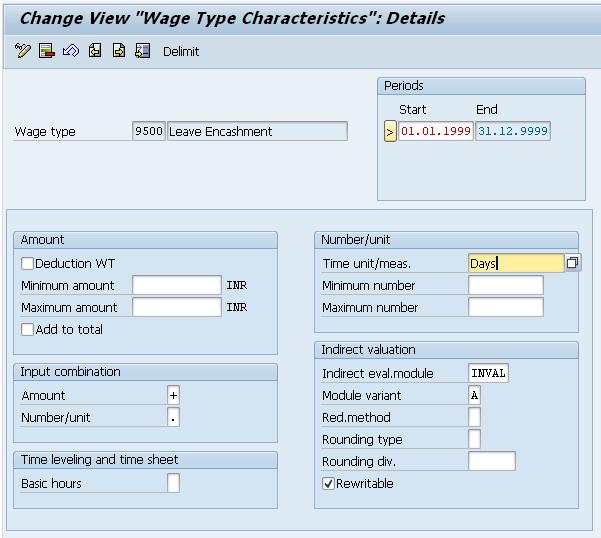

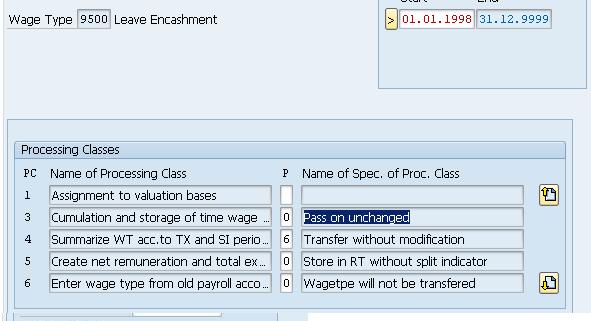

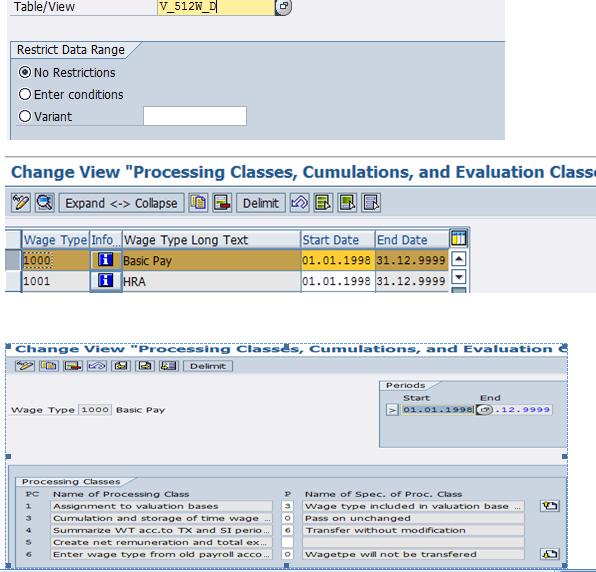

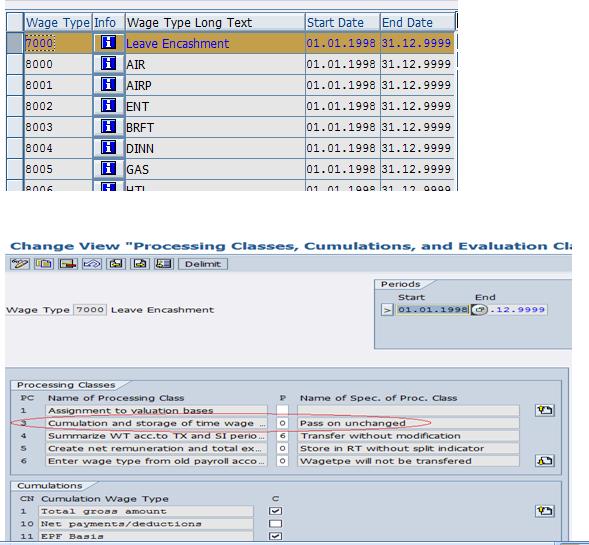

6. Check Wage Type Characteristics

Table no. V_T511

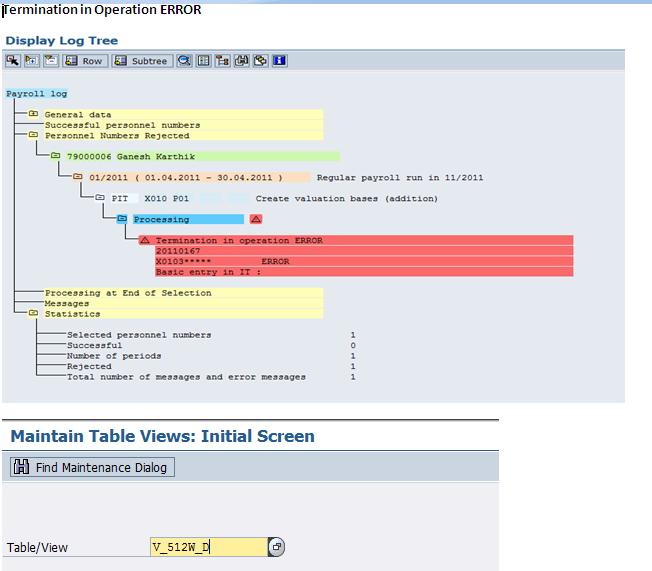

Table no. V_512W_D

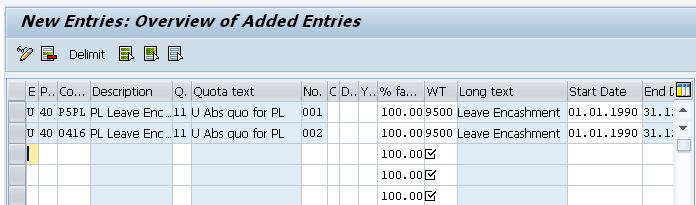

7. Assign Wage Types to the Quotas to be Compensated

Table no. V_T556W

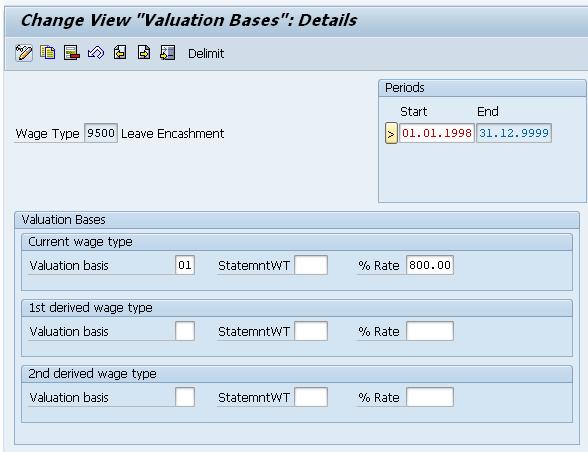

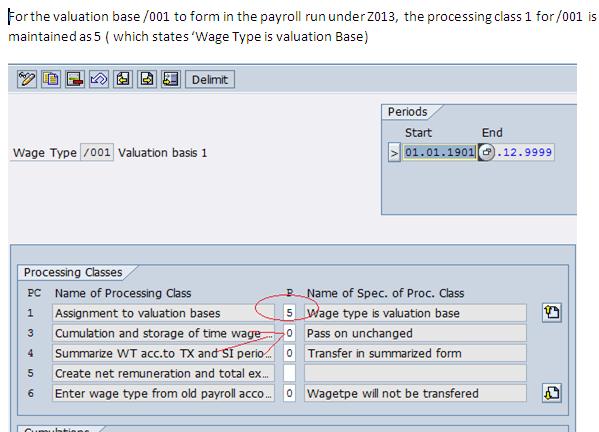

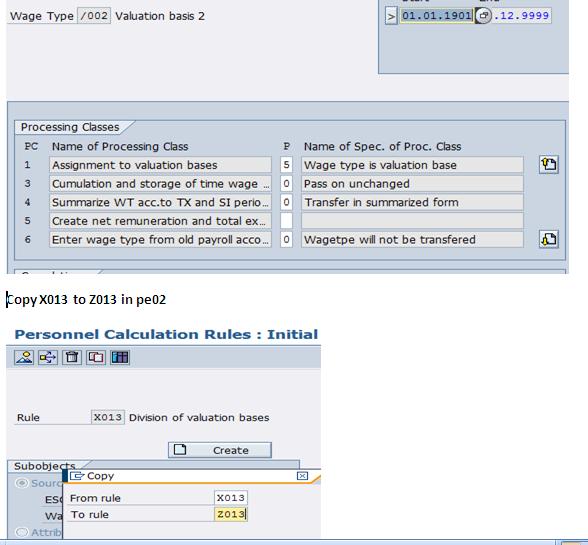

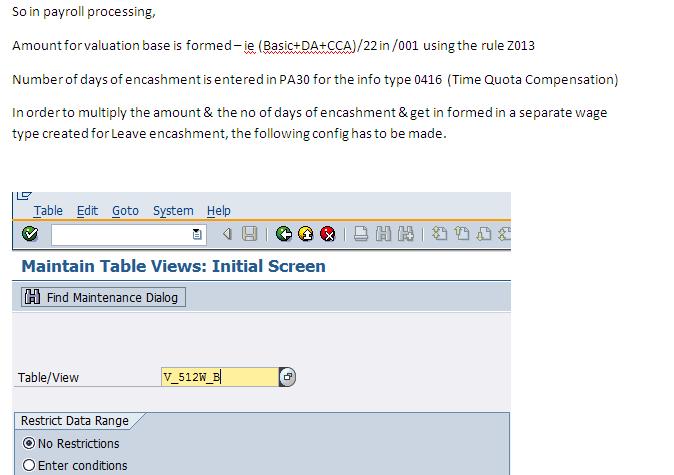

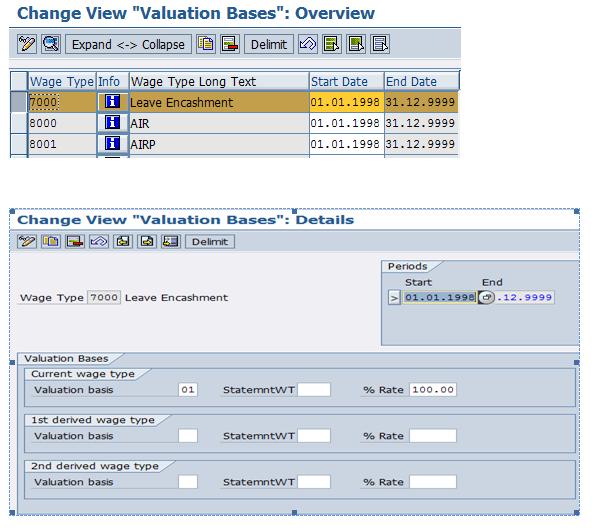

8. Valuation Bases

Table no. V_512W_B

*If we are writing PCR no need to configure this table.

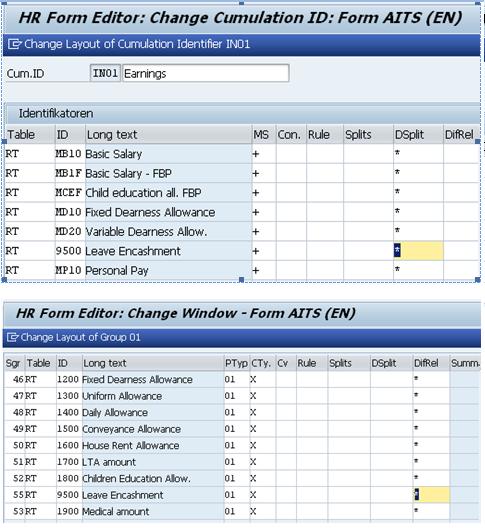

9. Add New Wage type in Remuneration Form PE51

T-code – PE51

Add New WT in the Form in Earnings side and in the Window 1 also

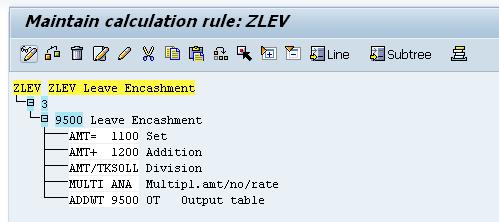

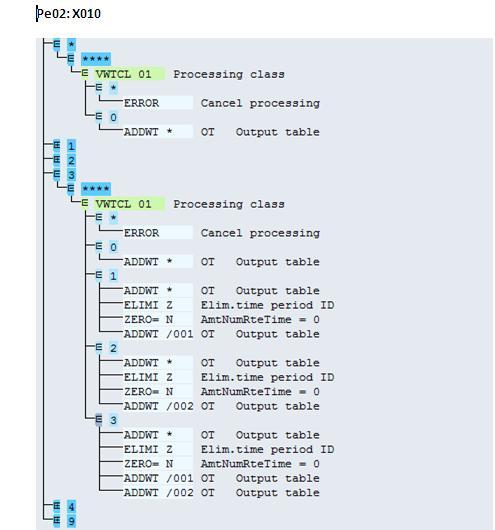

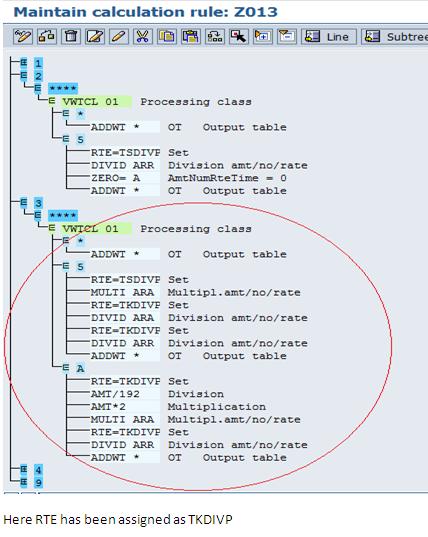

10. PCR (PE02)

According to rule, leave encashment is calculated on Basic and DA only

Taken only Basic and DA

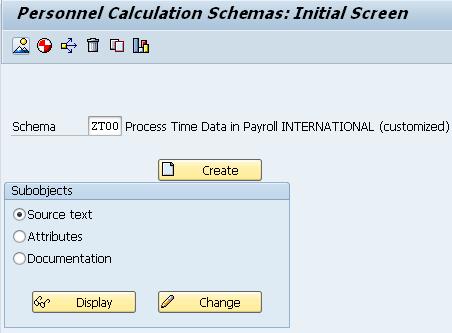

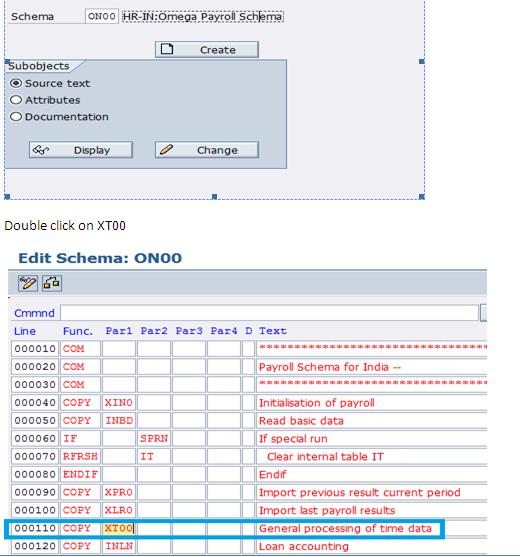

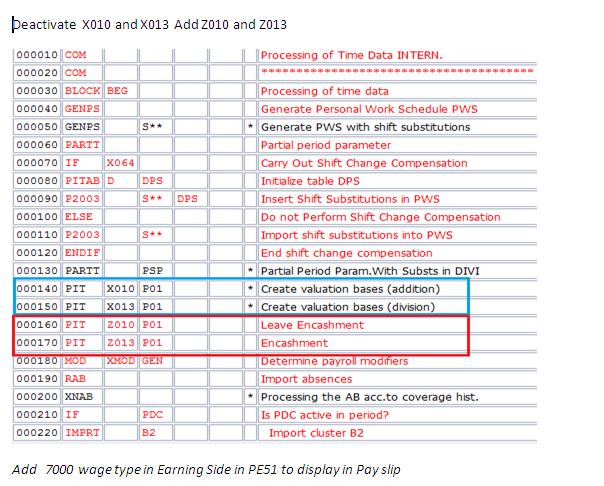

11. SCHEMA (PE01)

Copy std schema XT00 to ZT00

Insert PCR after Function P0416

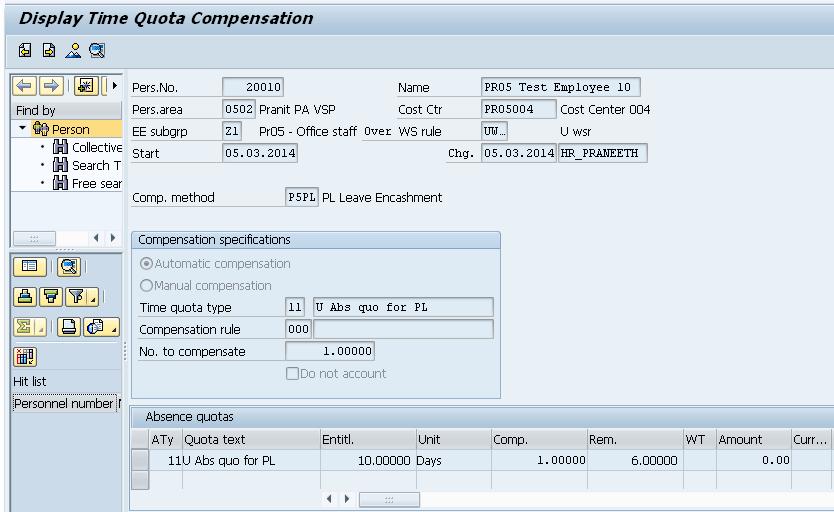

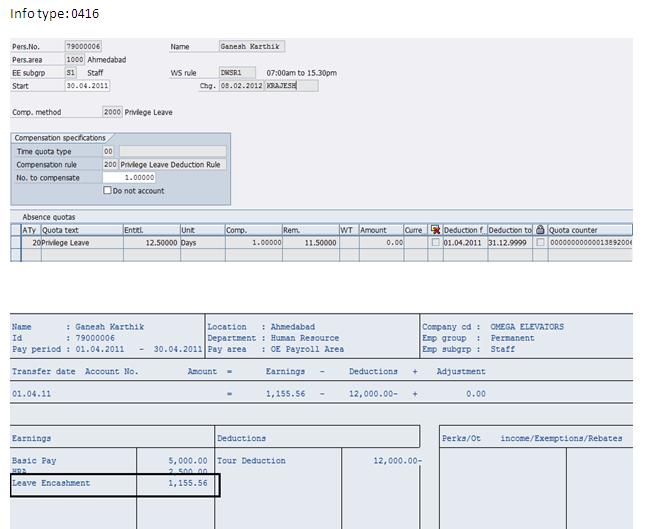

12. IT 0416

PL Encashment for 1 day.

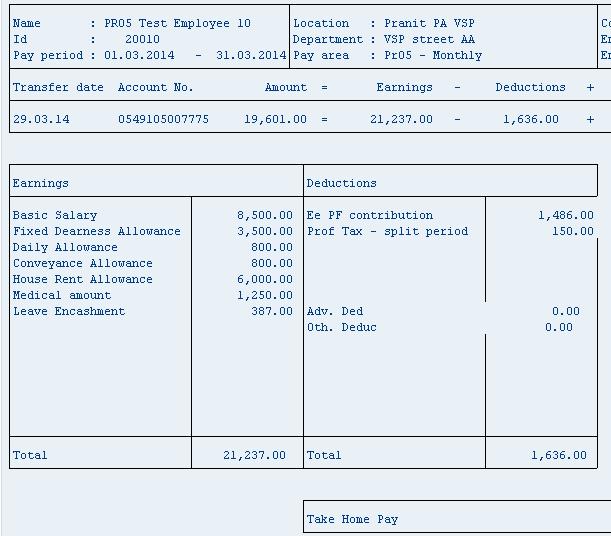

SALARY SLIP:

Go though the below Document for Leave encashment through Off-cycle payroll run

Leave Encashment through Off-Cycle Payroll

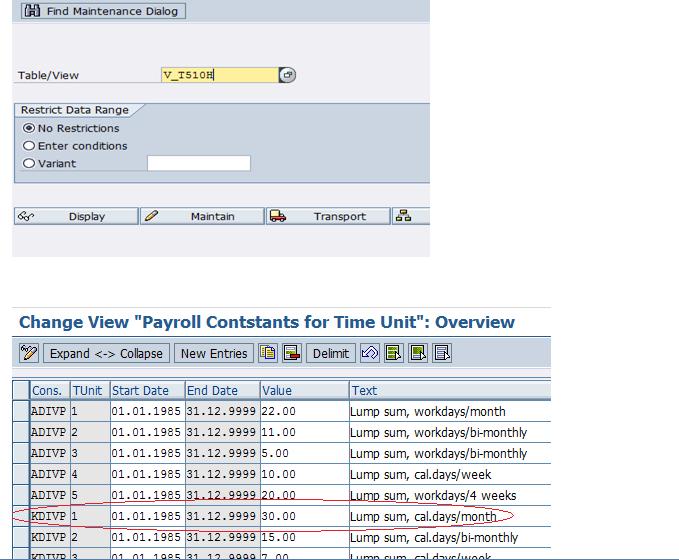

It should calculate on Basic Pay Divided by number of working days For example Basic Pay is 10,000 If an employee encash 1 leave he will be receiving Rs 333 for one leave Similarly if he encash two leaves He will be receiving Rs 666

Please go through attachment. Once Iam done with that I will try another Scenario. This is Basic Scenario which I would like to try first.

Leave A Comment?

You must be logged in to post a comment.