Hi Friends,

I like to share one scenario recently done for my client, Employee Termination Action done so long back now they came up with some payments has to do for that Terminated Employee.

Payments done through IT 0015 – Additional Payments

Prerequisites:

After Employee Resign / Terminated Standard Info types are not Delimited like 0007, 0008, 0009, 0014, 0015. otherwise while running payroll grouping error will come.

Step wise process:

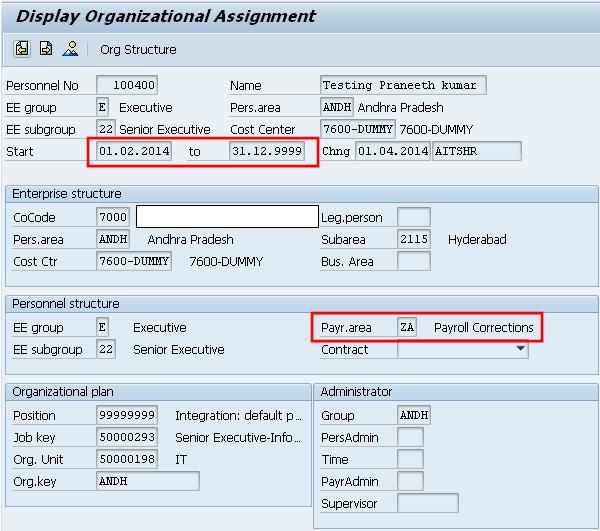

- Copy IT 0001 and change the Payroll Area to “Dummy Payroll Area” from the Date of Payment Month. Otherwise if employee is in the same Payroll Area Retro payroll will run.

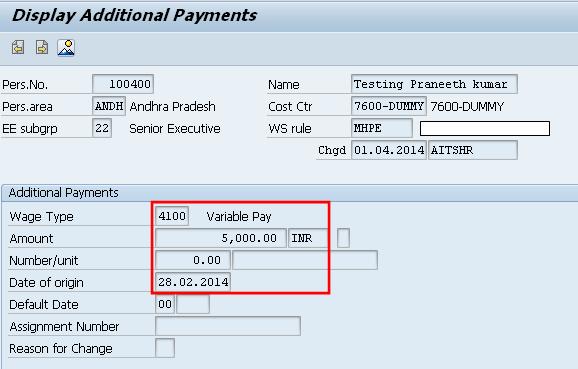

- Maintain IT 0015 with Sub type XXXX for Specific Date and Amount on which month payment has to made.

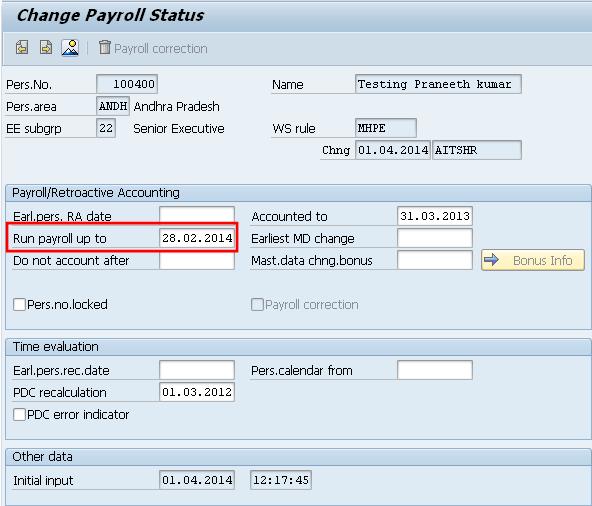

- Employee Payroll status has to change, maintain payroll month date in the field “Run Payroll up to”.

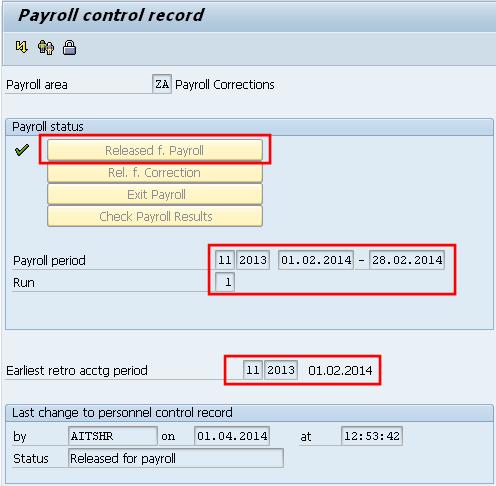

- Payroll Period and Earliest retro accounting period is to be current payroll month in the control record of dummy payroll area.

- Run Payroll Test run and Live run.

- Change payroll status has to maintain the period “Do not account after”

Screen shots for easy understanding:

1. IT 0001- Organizational Assignment

2. IT 0015 – Additional Payments

3. PU03 – Employee Payroll Status

4. PA03 – Payroll Control Recrod

5. Payroll Run – PC00_M40_CALC

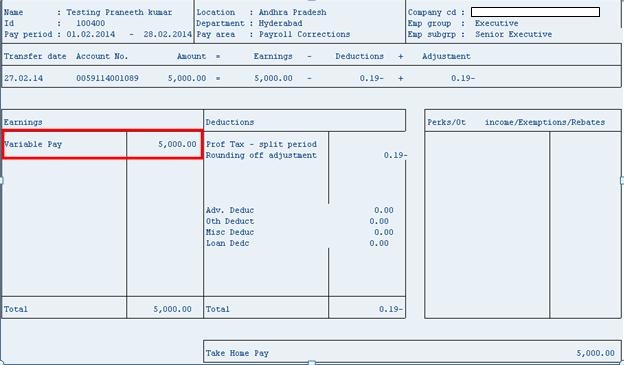

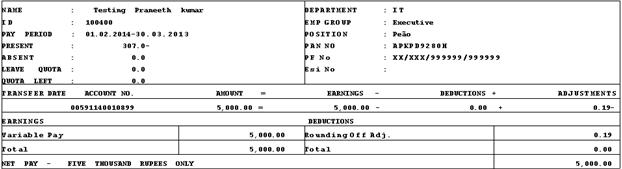

6. Zpay (payslip client customized)

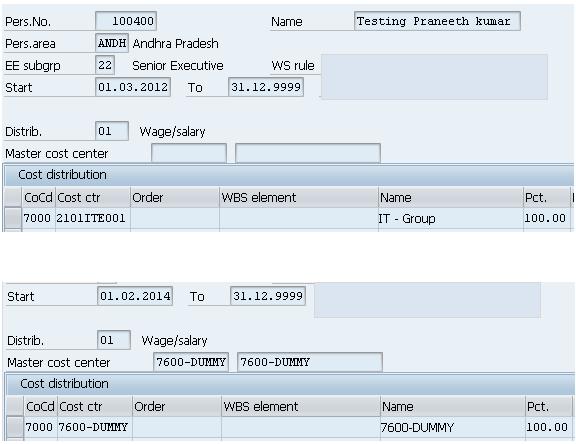

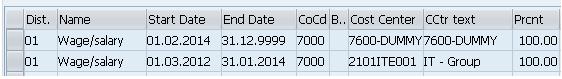

7. IT 0027 Cost Distribution Employee master data change

Cost Center has to change from the Date of Payment Month.

* According to the Client requirement we consider IT 0001 cost center while postings also, that’s why we need to change the IT 0001 also.

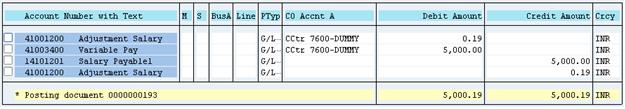

8. Posting to FI

Thanks for reading my Document.

Please share your comments and suggestions if any.

Thanks and Best Regards

Leave A Comment?

You must be logged in to post a comment.