Introduction

An Off-cycle workbench in SAP is a user interface that facilitates us to carry out off-cycle payroll and reversals. Off-cycle payroll runs are used to make payments to the employees outside the regular payroll run. Unlike Regular payroll run, there is no fixed date to execute an off-cycle workbench. Off-cycle payment and be viewed via Results table and can be posted to G/L accounts.

It is recommended to use off-cycle workbench if executing for a single employee. Otherwise, it’s better to use the payroll driver (using Off-cycle reason) if intended to run for mass employees.

Note: The default payment method through off-cycle workbench is cheque and through payroll driver, it is bank transfer.

Off-cycle workbench a different component altogether and doesn’t affect regular payroll as such. However, off-cycle postings need to be done separately by using correct payroll type and payment date in postings and identifier, if used.

Example: If the current payroll period is from 01.04.2015 and 30.04.2015, and the pay date is 25.04.2015, then off-cycle payroll runs can be executed between 26.04.2015 and the date when the Payroll Control Record is released for the next payroll run.

Off-cycle payroll can be run for the following Reasons (not exhaustive):

- Bonus payment

- Correction Payment/ Late adjustments

- Advance leaves

- Late hire/ Retro termination, etc.

- On demand/ Advance Salary

Advantages of running of an Off-cycle workbench

- Off-cycle payroll run lets us adjust for all erroneous payroll

- Bonus payment for a special occasion can be given to the employees in the mid of a payroll cycle.

- It allows us to carry out an immediate correction run

- Payroll for several periods in advance. For ex, an employee is leaving the company

- Individual Off-cycle Payment Run can be run

- Mass Off-cycle Payment Run

Prerequisites for running an off-cycle workbench:

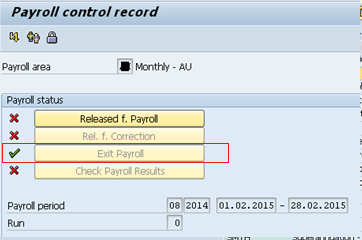

- The Payroll Control Record needs to be in the Exit Payroll stage

- The off cycle run must be executed after the pay date of the regular payroll run.

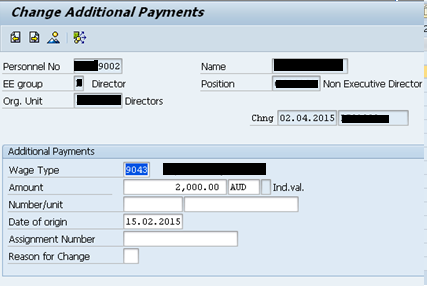

Additional Off-cycle Payments Infotype(IT 0267):

This is the infotype in which additional wage details can be stored that are only used once or irregularly for off-cycle payroll. However, this infotype is not available in all countries.

IMG Navigation:

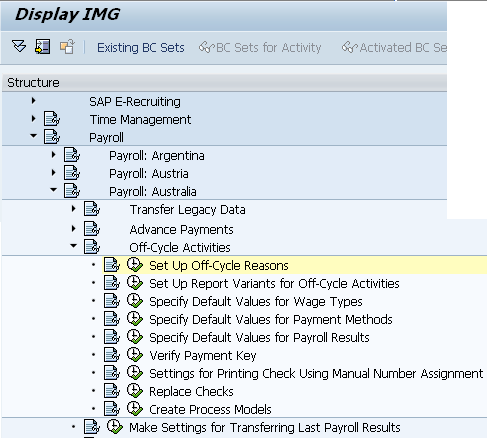

Activities like off-cycle reasons, setting up of variants etc. can be configured via following IMG path:

SPRO > Payroll > Payroll: Country > Off-cycle Activities

Procedural Steps

Taking an example of Late Adjustment scenario to execute Off-cycle Workbench.

Scenario: Payroll had been successfully run and posted for a given employee (Payroll Country: Australia). Once the pay-period is exited, there is a payment adjustment (retroactive) done in IT-0015 for the employee in the exited pay period. So we run an off-cycle workbench to pay the late adjustment amount to the employee.

A. Successful regular Payroll run for a given pay period: 01.02.2015 to 28.02.2015. Payroll results available in RT table and effectively posted to Financial Accounting.

B. Change the Payroll Control Record to Exit Payroll stage for the given pay period via transaction PA03

C. Maintain a retroactive payment for the employee in IT-0015 for the exited pay-period via transaction PA30.

D. Go to Off-cycle Payroll Workbench using Transaction PUOC_XX (where ‘XX’ denotes the country grouping to which the employee belongs).

For ex, If an employee is from India (Country Grouping: 40), the Transaction used is ‘PUOC_40’. Similarly, for Great Britain- 08, Australia- 13, New Zealand- 43 etc.

The first tab above shows the history of the payroll runs for the employee. Columns above represent the following:

- Payment Date: This field contains the payment date for the payroll run.

- Payment Reversed: This field shows up an icon when there is a payment reversed for the employee

- Payment Replaced: This field shows up an icon when there is a payment replaced for the employee

- Payment Information: Bank Transfer/Cheque information- Date, A/C no. etc.

- Payment Method: Payment through Bank Transfer/Cheque/Cash etc.

- Payment Number: The payment can either be made via cheque or by bank transfer. The content of this field displays the payment

number and depends on the payment type. - Reason: Reason for Off-cycle payroll

- Amount

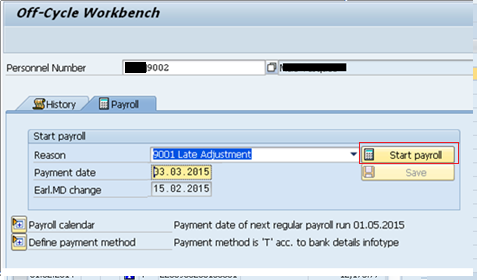

E. Go to the next tab—‘Payroll’  . Mention the payment date and select the off-cycle reason.

. Mention the payment date and select the off-cycle reason.

The EMD value refers to the Earliest Master Data change which can also be found in IT-003.

F. Run off-cycle payroll for the employee by clicking on ‘Start payroll’ button

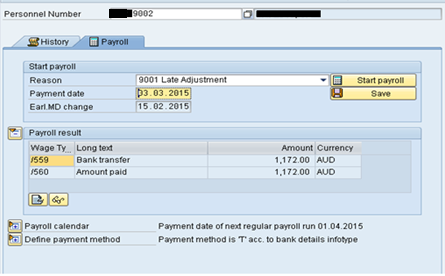

G. The late adjustment amount is appropriately calculated as above. Make sure the payroll run has been saved in order to be

updated in the results table.

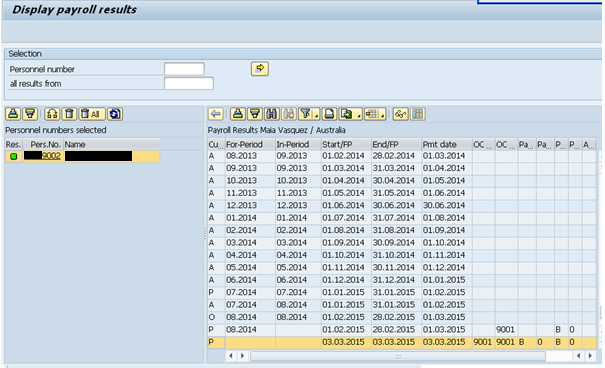

H. This can be generated in pay-slip and the results table. Use transaction PC_PAYRESULT.

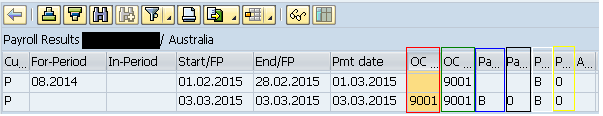

Emphasizing on the last two rows as below:

The first row denotes the regular payroll run during which the Off-cycle payroll has occurred.

The second row denotes the off-cycle payroll run.

- Highlighted in red box and green box represent reason for off-cycle payroll—For period and In period respectively. In the screenshot above, this field for is blank for the first row (regular payroll); and has a value in the second row (offcycle payroll). 9001 is the customer specific reason code—can be maintained via table V_T52OCR.

- Highlighted in blue box and white box represent Payroll type—For period and In period respectively. Here are the following options:

- Blank: Regular Payroll

- A: Payroll run for bonus payments or absences

- B: Correction run due to a change in master data

- C: Payroll run for payments from the Payroll Results Adjustment infotype (0221)

- S: Payroll run for supplemental payments within function Multiple Checks in One Cycle

- Highlighted in black box and yellow box represent Payroll identifier —For period and In period respectively. It is used to distinguish between different off-cycle payroll runs created on the same day.

- The last column in the table (no highlight) represents Archiving Group that contains all global information for archiving HR accounting data

I. This can be further posted to G/L accounts for the employee.

Replace Payments

A payment is replaced in case:

- An employee didn’t receive his payment through bank transfer.

- The issued cheque is unusable by the employee.

Reverse Payment

Payroll results can be reversed for both regular and off-cycle run. The system reverses all payments that belong to the particular payroll run.

Leave A Comment?

You must be logged in to post a comment.