Welcome to the tutorial on SAP Indirect Activity Allocation. In our previous article, we discussed Cost Allocation process and mentioned the concept of activity type because cost element and activity type are related in overall allocation process. This tutorial is part of our free SAP CO training course.

In the practical scenario, often we face difficulty to ascertain correct cost to be transferred from one cost center to another. In this tutorial, we will discuss how activity type cost is allocated from one cost center to another using SAP Indirect Activity Allocation method.

In production industries, SAP Indirect Activity Allocation process is mainly used in terms of scenarios like energy cost calculation where it is required to allocate costs to a receiver cost center based on activity type. In this tutorial, it will be shown how a separate allocation cycle is prepared where cost is assigned based on production related cost center activity.

SAP Indirect Activity Allocation – Key Concept

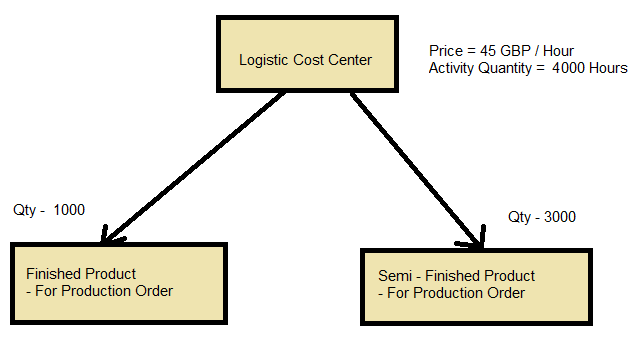

Direct activity allocation is not always possible for a dynamic organization with a complex operation procedure. For example, a logistic department (CCLOG – Cost Center) is spending time in packing finished and semi-finished goods. In that case, it is difficult to calculate the time spend on packing each product. In such a scenario, indirect activity allocation is performed based on the output of finished / semi-finished goods.

Within indirect allocation process, both plan and actual activities are used to be allocated. In this case, self-defined keys are assigned to allocate activities. Now, let’s check out the following illustration:

According to the above scenario, Logistic Cost Center incurs cost in packaging:

45 GBP X 4000 Hrs. = 180000 GBP

Now, we will allocate this cost based on the output:

- Finished Goods Production Order (180,000 GBP X 1000 Hrs.) / 4000 Hrs. = 45,000 GBP

- Semi- Finished goods Production Order (180,000 GBP X 3000 Hrs.) / 4000 Hrs. = 135,000 GBP

In SAP terms, we will need to allocate the above cost relating to the packaging activity from the Logistic Cost center to Repair Department and Warehouse Department cost centers. That means that Repair Cost Center (CCRC) and Warehouse (CCWH) are used as receiver cost centers where costs will be debited according to the related tracing factors / weighting factors. As per the above example, to allocate the above related cost based on the packaging activity in SAP, we will first need to create a cycle for SAP indirect activity allocation.

Define Activity Type for SAP Indirect Activity Allocation

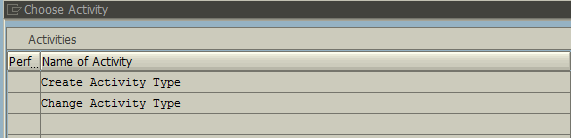

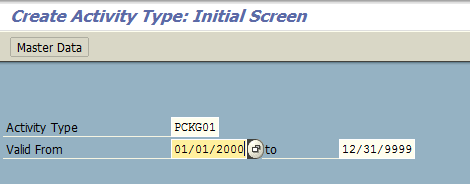

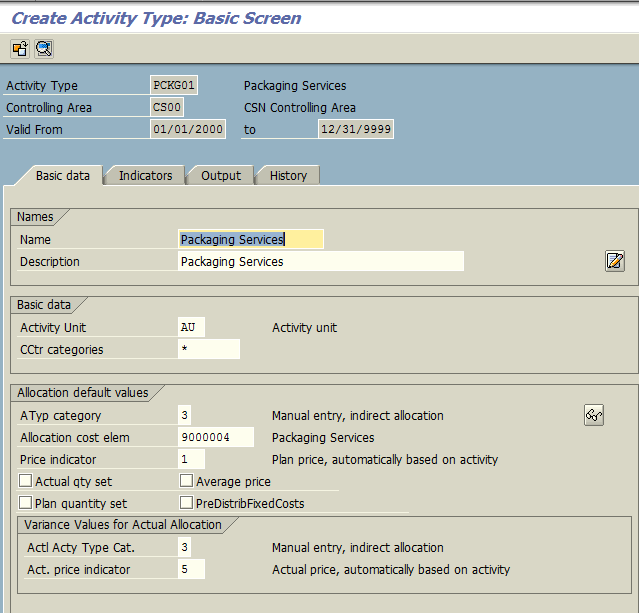

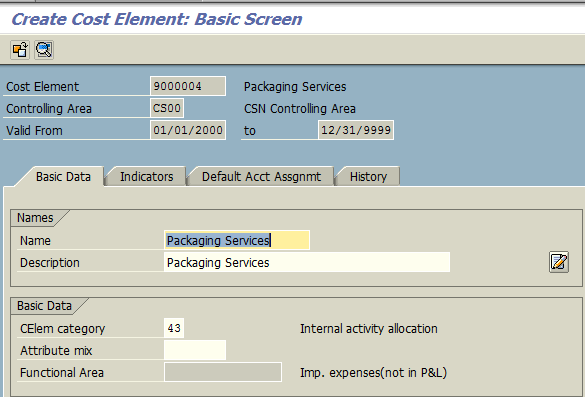

IMG -> Controlling -> Cost Center Accounting -> Planning -> Allocations -> Activity Allocation -> Indirect Activity Allocation -> Define Activity Types for Indirect Activity Allocation

Transaction Code: KL01

Prerequisites: Need to create a secondary cost element with cost element category 43 (for indirect activity allocation) of those packaging units.

Define Activity Cycle for SAP Indirect Activity Allocation

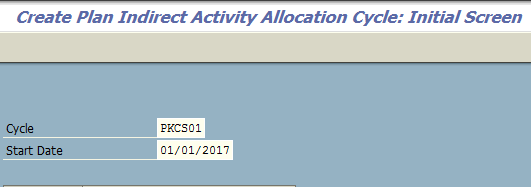

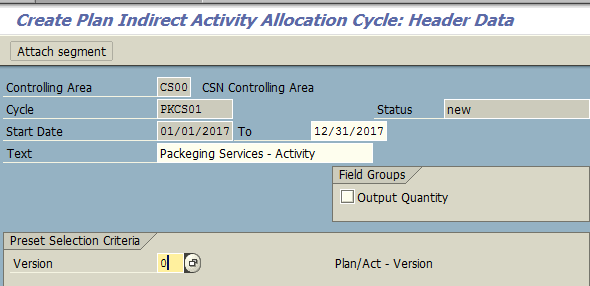

Now, we will create a cycle to allocate costs relating to the activity Packaging Services from Logistics to Finished Product and Semi-Finished Product.

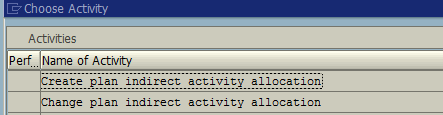

IMG -> Controlling -> Cost Center Accounting -> Planning -> Allocations -> Activity Allocation -> Define Indirect Activity Allocation

Transaction Code: KSC7

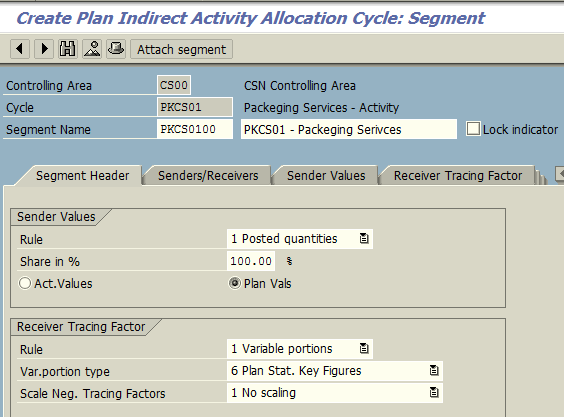

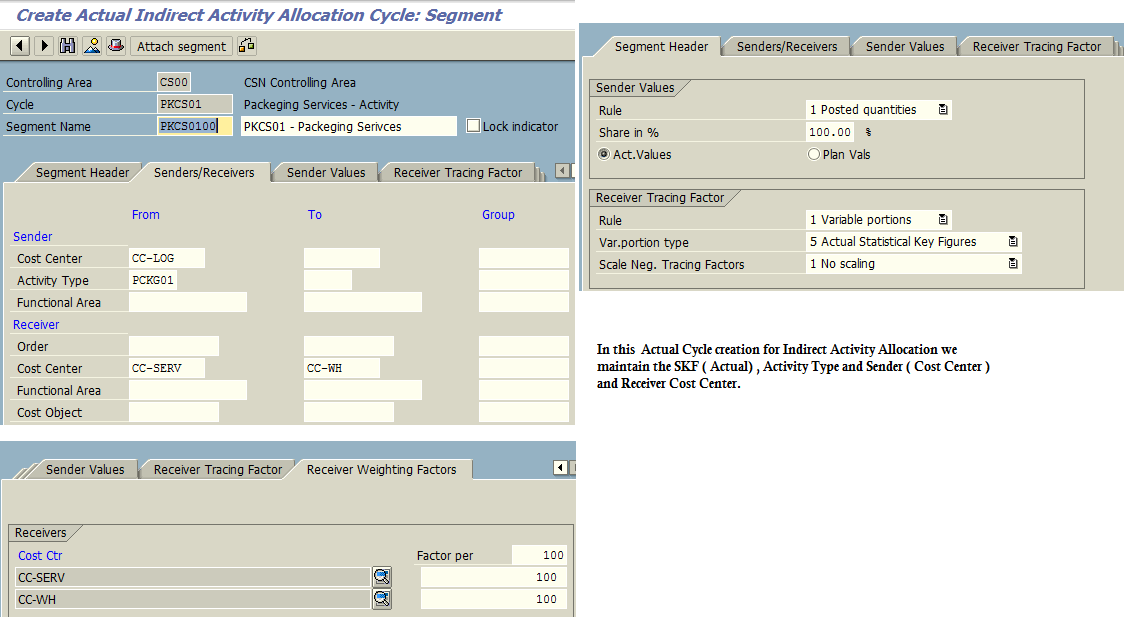

In order to complete the cycle, certain options are available to maintain under Sender and Receiver respectively. Under Segment Header / Sender, posted quantities are required to be chosen since here quantities / units are considered as Sender Values. The quantities / no of units are generally calculated inversely from the Receiver tracing factor as well as valuated from senders.

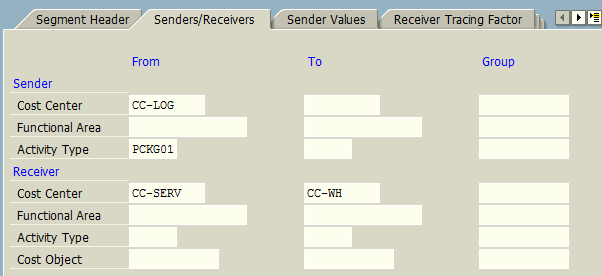

Under Sender / Receiver tab it is required fill up the following. Under Sender Cost Center we will put the Cost Center belonging to Logistics since cost related to indirect activity (packaging units) will be allocated and also input activity type PCKG01 (created earlier).

Under Receiver Cost Center we will put the following cost centers:

- CC-SERV: Service Center

- CC-WH: Warehouse

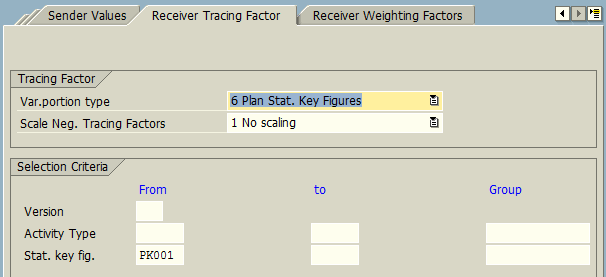

On Receiver Tracing Factor tab we will enter Statistical Key Figure contining the units of measurement (in this case it is AU ( Activity Units)).

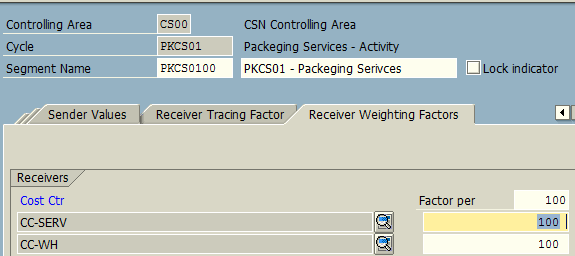

The final tab is Receiver Weighting Factors. Here, receiver cost centers (CC-SERV and CC-WH) will be maintained with applicable tracing.

Once indirect activity cycle is created, it can be saved for future use. Using the transaction code KSC8 you can also display indirect activity cycle.

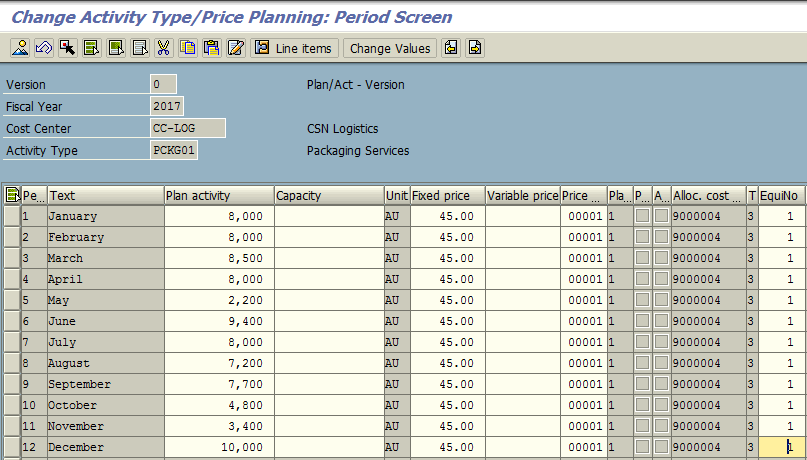

Enter Activity Price

Accounting -> Controlling -> Cost Center Accounting -> Planning -> Activity Output/Prices -> Change

Transaction code: KP26

Here we can enter fixed price for each activity. In this case, PCKG01 and sender cost center CC-LOG. Based on the activity unit, the price will be allocated.

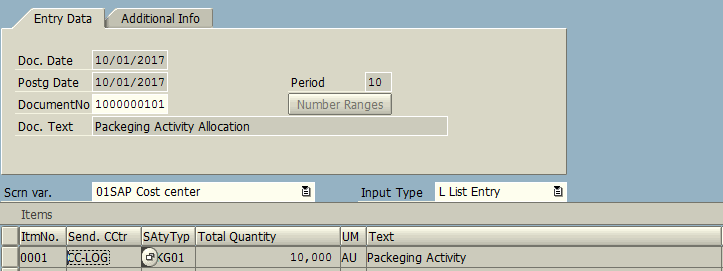

Enter Sender Activities

Accounting -> Controlling -> Cost Center Accounting -> Actual Postings -> Sender Activity

Transaction code: KB51N

Here, we send 10,000 units as packaging activity from CC-LOG (Logistics Cost Center).

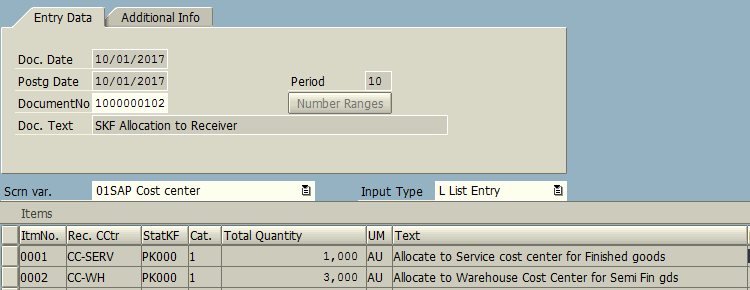

Create Segment for Receiver Cost Center with Statistical Key Figure

Accounting -> Controlling -> Cost Center Accounting -> Actual Postings -> Enter Statistical Key Figure

Transaction code: KB31N

Here, we have allocated the quantity of activity units to the receiver cost centers CC-SERV and CC-WH.

Create Actual Indirect Allocation Cycle

Accounting -> Controlling -> Cost Center Accounting -> Period-End Closing -> Current Settings -> Define Indirect Activity Allocation

Transaction code: S_ALR_87005792

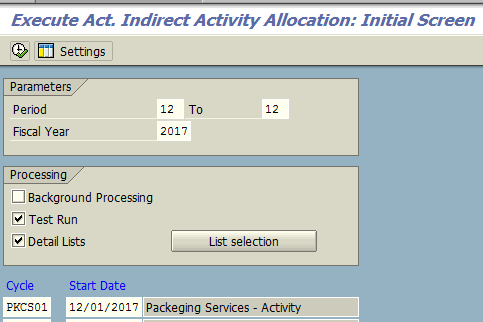

Execute SAP Indirect Activity Allocation Cycle and Segment

Accounting -> Controlling -> Cost Center Accounting -> Period-End Closing ->Allocation -> Indirect Activity Allocation

Transaction code: KSC5

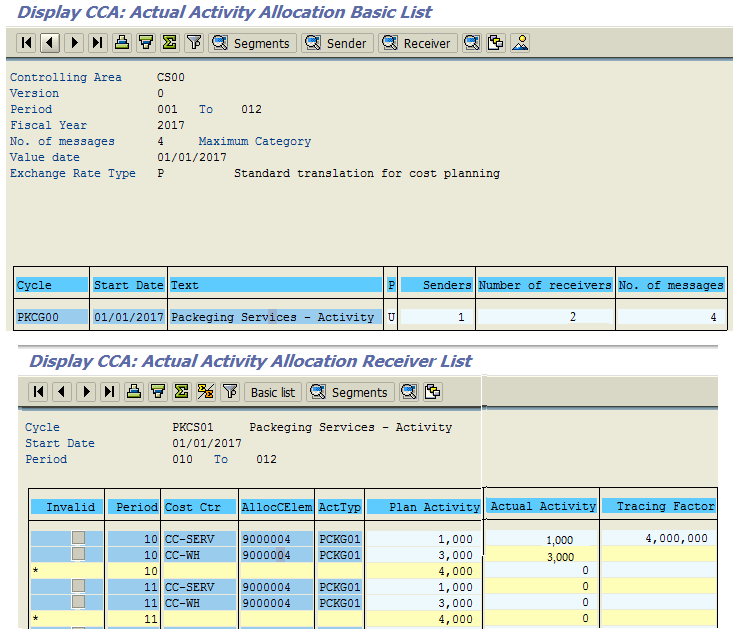

Quantity / price allocated from the sender cost center CC-LOG (Logistics Cost Center) to receiver cost centers are based on the tracing factors.

After successful allocation of costs related to indirect activity, we can see that the receiver cost centers are credited and the sender cost center is debited. The report can be displayed in cost center line items display.

Leave A Comment?

You must be logged in to post a comment.