Welcome to the tutorial where we will provide SAP CO overview. Within the SAP Financials ERP Central Component, there are two areas in which financial information is recorded, reported, and managed. The first of these is the Financial Accounting component, commonly referred to as FI. The second component is Controlling, commonly referred to as CO. These two components are so tightly integrated that they are often thought of as one module, SAP – FI/CO. The purpose of this tutorial is to explain the key distinctions of Controlling from Financial Accounting and to give a broad overview of the widely used areas of the CO component.

Key Differences between CO and FI

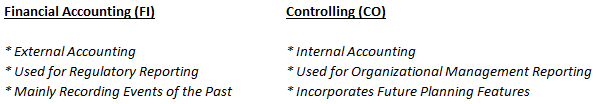

Let’s start our tutorial on SAP CO overview with explaining the differences between FI and CO modules. There are some key differences between FI and CO that you should be clear on before examining the main functionality of the CO module. The first distinction is that FI is used for external reporting. The functionality included is what you may think of with typical accounting functions such as general ledger, accounts payable, accounts receivable, fixed assets, etc. The results of these functions are highly regulated by legal requirements and are required to be accurate and timely. CO, on the other hand, is used by an organization’s internal managerial accountants and is for internal analysis and strategy development. Another distinction to understand is that while the results of FI are the “final end product”, the results of CO are simply tools used to make other managing decisions within an organization. Finally, keep in mind that FI is generally the recording of an action that has taken place in the past – an item has been purchased or sold, as asset has been used and depreciated, etc. CO, on the other hand, heavily uses future planning and projections for management decisions. CO is used to compare actual results to planned results. Review the chart below for a recap of the main differences:

SAP CO Organizational Structure

We have a dedicated tutorial on SAP CO organizational structure but let’s briefly mention it this tutorial on SAP CO overview as well. There two main high level organizational units we will briefly examine here – the Controlling Area and the Operating Concern.

Controlling Area

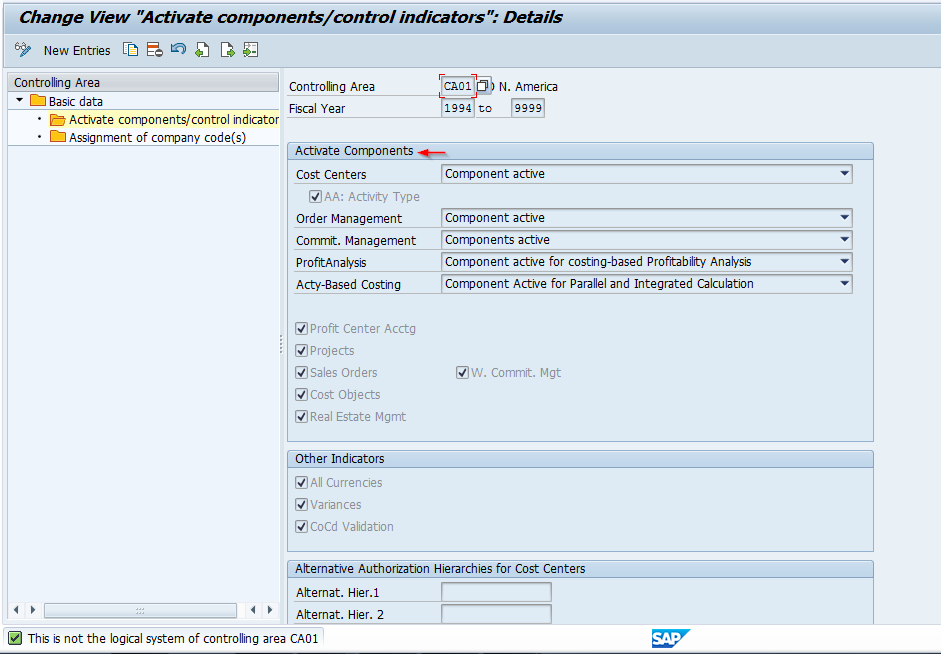

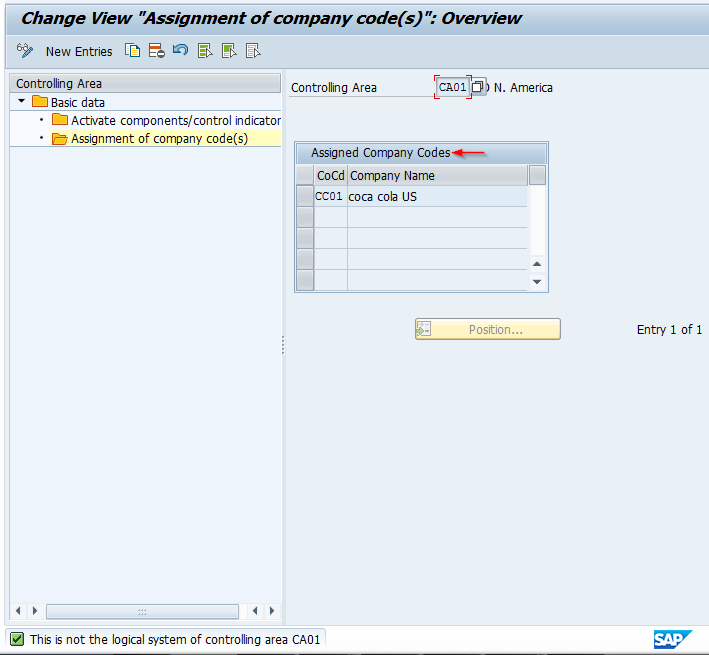

The Controlling Area is highest level of organization within the Cost Center Accounting function of CO and is the main organizational link from the FI module to the CO module. Within the definition of the Controlling Area, you activate the areas of functionality of CO you will be using, as well as assign the company codes from FI that will be linked. This is configured during the implementation of SAP and usually not changed once the system is live and running. Use transaction OKKP to see an example controlling area – notice the choices in functionality available for activation as well as the ability to assign multiple company codes to a single controlling area.

Operating Concern

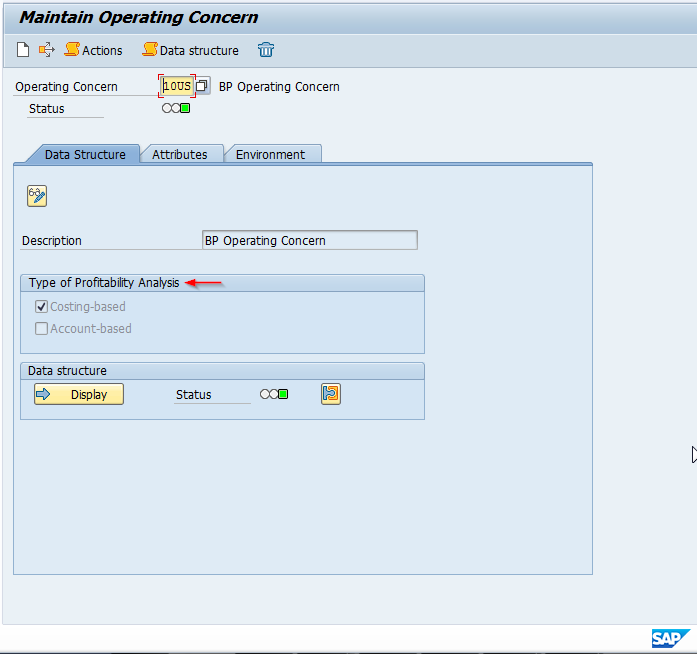

The next organizational unit we will look at is the Operating Concern. The Operation Concern is the highest level of organization used within the Profitability Analysis function within CO. Profitability is analyzed based on characteristics such as product, sales office, etc. Values within the characteristics measure the profitability in which management uses to make strategic business decisions for an organization.

Using transaction KEA0, take a look at a sample Operating Concern and review a key setting that you should understand – Type of Profitability Analysis. Your choices here are Costing-Based or Account-Based. You can choose one or the other or both simultaneously. Costing based uses costing based valuation fields to analyze, while account based uses cost and revenue elements that are reconciled with FI. This may seem unclear at the moment, but as you work with and learn more about CO, it will begin to make sense. Below is an example of where you will find this setting.

SAP CO Key Components

Here we will discuss the key components of SAP CO. This is a very wide ranging topic, and in this SAP CO overview we will just define each to give you an idea of the available functionality. This list follows the folder order under the SAP Easy Access Menu for Accounting > Controlling.

- Cost Element Accounting – functionality that categorizes costs by type; costs can originate in FI (primary) or be CO independent (secondary).

- Cost Center Accounting – this functionality centers around accounting based on costs within a single entity of an organization.

- Internal Order Accounting – function that allows tracking of specific events that are company code dependent; costs eventually “settle” to other areas of CO.

- Activity Based Costing – functionality allowing costing based on assignment to very specific business processes.

- Product Costing – complex functionality used to analyze costs incurred during a product’s manufacturing process; highly integrated with other areas of CO as well as logistics modules such as Materials Management and Production Planning and used in make or buy decisions.

- Profitability Analysis – management accounting tool used to evaluate profitability of predefined market segments or business units from an external perspective.

- Profit Center Accounting – functionality centered on accounting of profit and losses of an organization by specific entity from an internal perspective.

SAP CO Master Data

Like other modules within SAP, CO has unique master data. In this SAP CO Overview, we will take a look at a list of some basic master data elements (some are referred to as cost collectors), give a brief definition of each, and an example of an integration point within other SAP modules.

- Cost element – this generally represents a type of cost much like a G/L cost account in FI; primary cost elements have corresponding G/L accounts in FI (costs originate in FI) whereas secondary cost elements do not (costs existing in CO only for internal purposes).

- Cost Center – this is a unit that represents a defined location of cost incurrence. An example of how this may integrate with other modules is the cost center field on a purchase order.

- Profit Center – unit representing a specific area of responsibility within an organization used within profit center accounting. An integration point with Materials Management is the profit center field held on a material master record.

- Internal Order – unit used for tracking costs on a specific ongoing event within an organization that will eventually be settled to other cost collector objects. An integration point example could be an internal order held on an asset master record.

- Work Breakdown Structure – cost collector unit within the Project Systems for activities related to a larger project and managed using networks. A WBS can be linked to MM via purchase order to PP by production order.

- Activity Type – master data element used within cost center accounting representing a specific activity performed; labor performed would be an example of an activity that integrates with HR CATS.

- Statistical Key Figure – a measurable value such as square footage, number of employees, or meal count in a cafeteria cost center; not really integrated with other modules and used strictly for allocating costs within CO.

Reconciliation with FI

The last point that we would like to mention in our SAP CO overview is reconciliation with SAP FI. Postings in CO result either from events in other modules, such as a general ledger posting to a G/L account with a corresponding primary cost element using one of the cost collector master data elements listed above, or directly in CO on secondary cost elements using a CO only transaction. It is possible for postings originating in CO to cross company codes or business areas, which causes a reconciliation difference between CO and FI. In older implementations of SAP ECC using the classic general ledger, this is managed using the CO to FI reconciliation ledger and transaction KALC. In later implementations, the new general ledger features real time integration so that separate reconciliation is no longer required. This key concept is worth noting here as many SAP implementations continue to use the classic general ledger functionality.

Conclusion

Controlling is a highly complex but integral part of an organization’s implementation of SAP Financials. This tutorial introduced some key organizational structures and the main functionality and master data used within the module, but each area has very detailed configuration and application of use within an organization overall financial management strategy. We hope that this SAP CO overview will be helpful in learning about controlling module of SAP.

Leave A Comment?

You must be logged in to post a comment.