Purpose

The purpose of this page is to clarify the behaviour of Professional Tax when payroll is not processed for a period . For ex : If one employee’s Salary was not processed in the month of May-2012. In the month of June-2012, Salary is released for the month of May-2012 , then what will be the Ptax Deduction.

Overview

Ptax deduction happens for different state differently . In some states , Gross Carry forward is followed and in some Deduction Carry Forward is followed. In GCF method the system recalculates the professional tax basis for the past periods. It carries forward the difference in the professional tax basis for each retrospective calculation period into the current processing period, and sums it up into the current processing period. In DCF method , the contribution difference is carried forward . One can change from one method to another via BADI provided . For ex : if one wants to switch from DCF to GCF , one can use BADI provided at Payroll->India->Statutory Social Contribution->Provident Fund->User Exit: Computation of PF by Gross Carry Forward Method.

Configuration

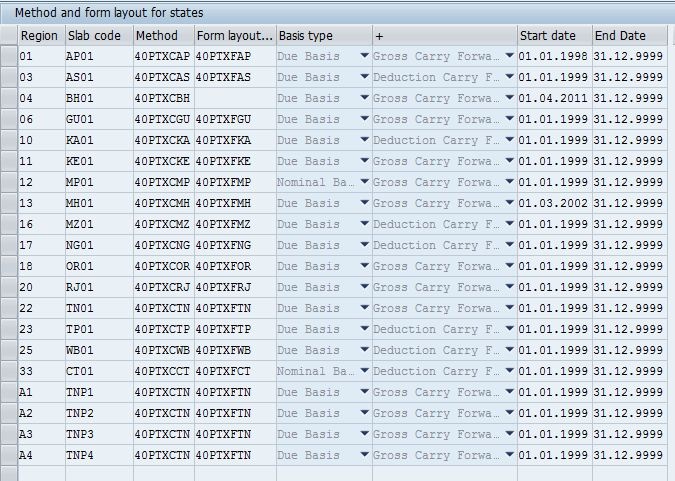

As per legal notice , whatsoever ptax deduction method is applicable in a state can be set from table : V_T7INP3.

Over here slab code refers to state . A state could have multiple panchayats too so you can see TNP1 , TNP2 etc. In this we can set whether DCF is applicable or GCF.

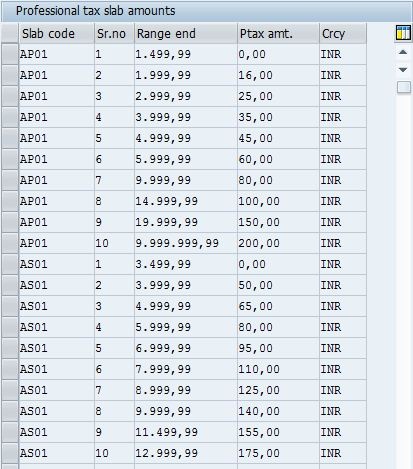

Slabs for this could be established in the Table : V_T7INP4

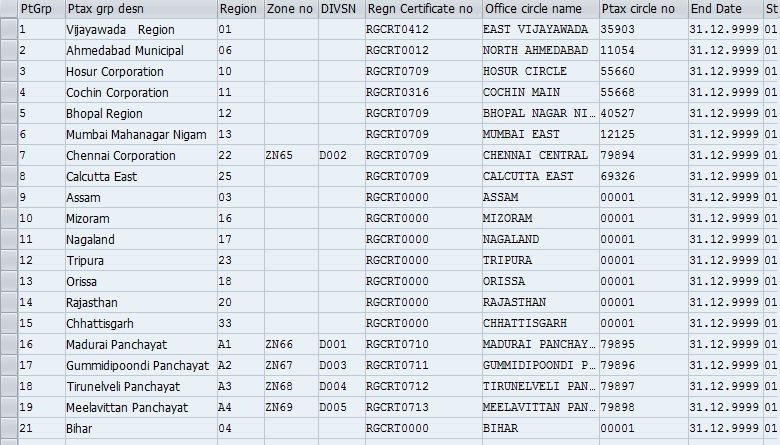

Professional tax grouping details could be done from table : V_T7INP1

Present Case Behaviour

This WIKI describes If one employee’s Salary was not processed in the month of May-2012. In the month of June-2012, Salary is released for the month of May-2012 as well. Now the common perception would be that system should deduct professional tax based on current month’s total earning , which is not the case in actual. What happens is , if the payroll is not run in any of the month then system by defaults takes as a deduction carry forward method. This is the standard bahaviour of the system.If the payroll record exist of the employee then the Gross Carry Forward method works but if there is no payroll run for the particular month then the actual run for that month will happen in the next month and due to that the ptax will be deducted for that month also as employee is getting the full salary. If the payroll is not run for a particular month then system by default takes the deduction carry forward method.

Conclusion

If payroll is not processed for a period and it is processed at a later time , then ptax deduction by default follows DCF method . Ptax is deducted for the unprocessed payroll month as well , in the month when the payout is made . It is not the case that system would deduct professional tax based on current month’s total earning rather it will deduct for all months whose payment is made in the current month.

Related Contents

Related Document

Related Notes

Recent developments in Payroll area could be seen from following Notes :

1750796: Madhya Pradesh Ptax – Alternate options for proration

1730541: PTax Tamil Nadu: Transfer Among Different Panchayats

Leave A Comment?

You must be logged in to post a comment.