Professional Tax calculation varies from one state to another, and you must define the Professional Tax calculation rules applicable to the employees depending on the state in which they are working.

In the system you organize your employee information within Personnel Areas and Personnel Subareas. This identifies the state of employment. Within a state, the employees also need to be grouped into different professional tax groups.

It is depending on the combination of the Personnel Area, Personnel Subarea and the professional tax grouping of the employee, that the system identifies factors such as the:

- Components of the professional tax basis.

- Method and the frequency of calculating and deducting professional tax.

- Salary range for the employee. The system deducts the professional tax amount based on the salary range that an employee falls into. The salary ranges and the tax applicable on a salary range is state specific.

- Format for the professional tax reports

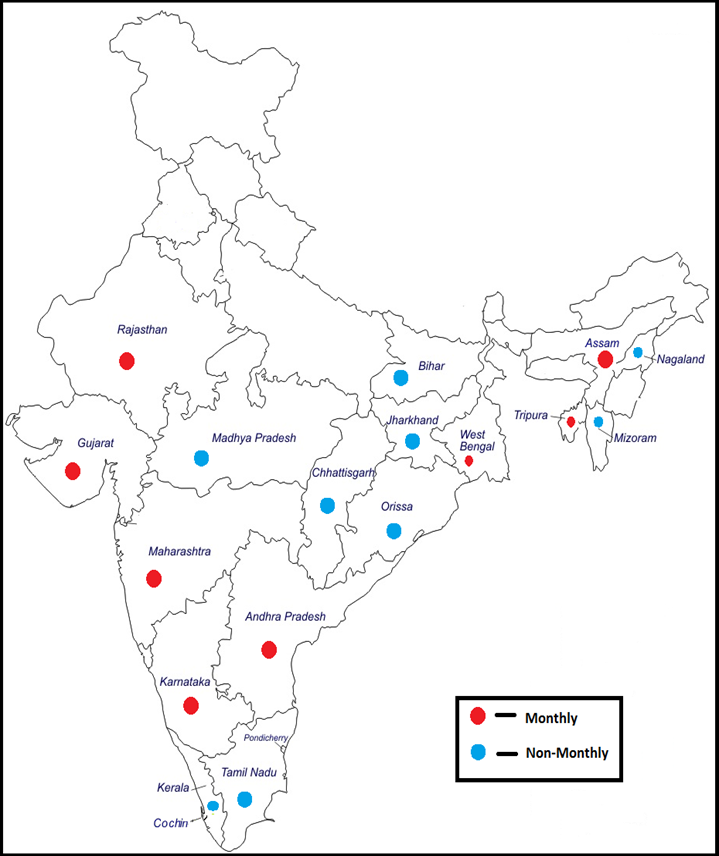

Professional Tax Region Classification

- Non – Monthly

Region = 11 (Kerala Panchayat )

Region = 12 (Bhopal Region)

Region = 16 ( Mizoram )

Region = 17 ( Nagaland )

Region = 33 ( Chhattisgarh )

Region = 32 ( Pondicherry )

Region = 04 ( Bihar )

Region = 34 ( Jharkhand )

Region = 14 (Manipur )

Region = D* , E* ( Cochin Corporation )

Region = 22, B*, C* ( Chennai Corporation)- Monthly

Rest Region ( As shown below)

- Monthly

-

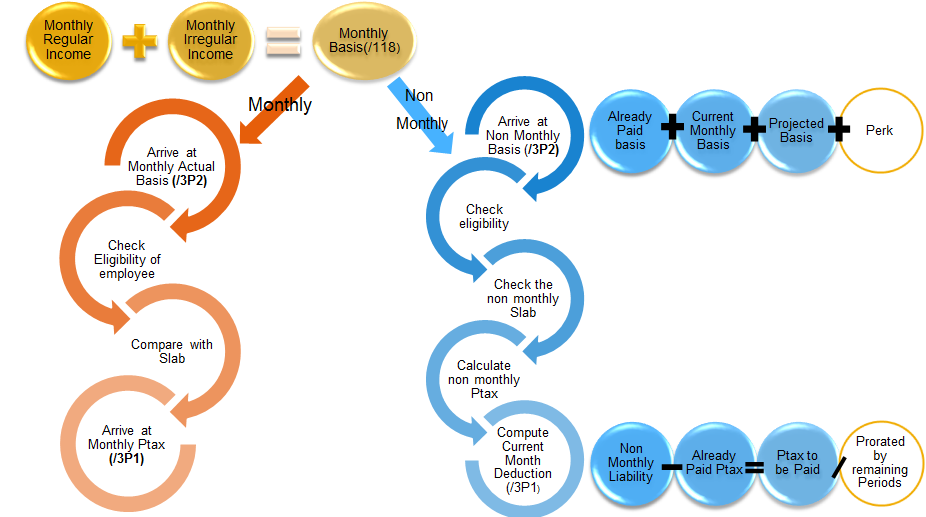

Professional Tax Calculation Flow:

-

-

-

-

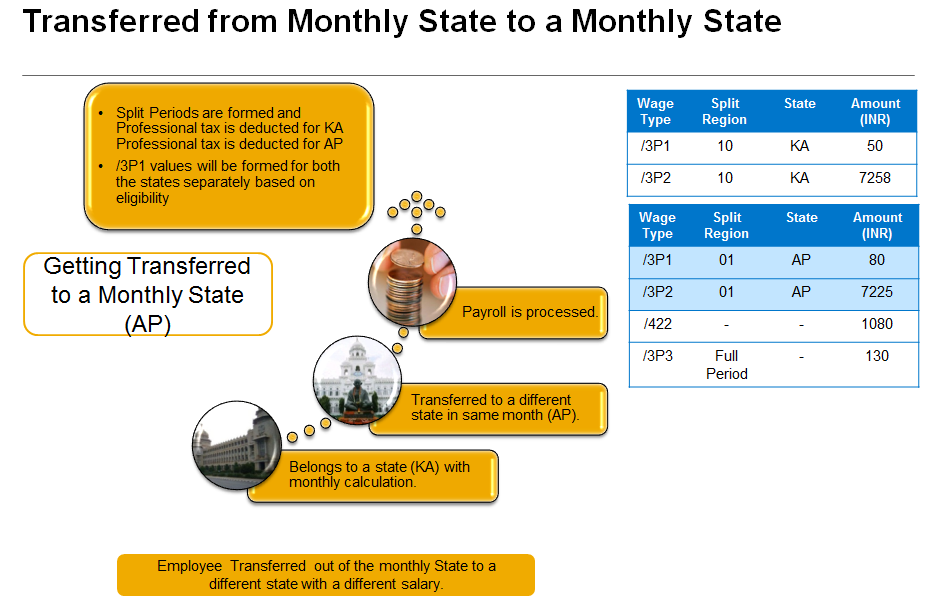

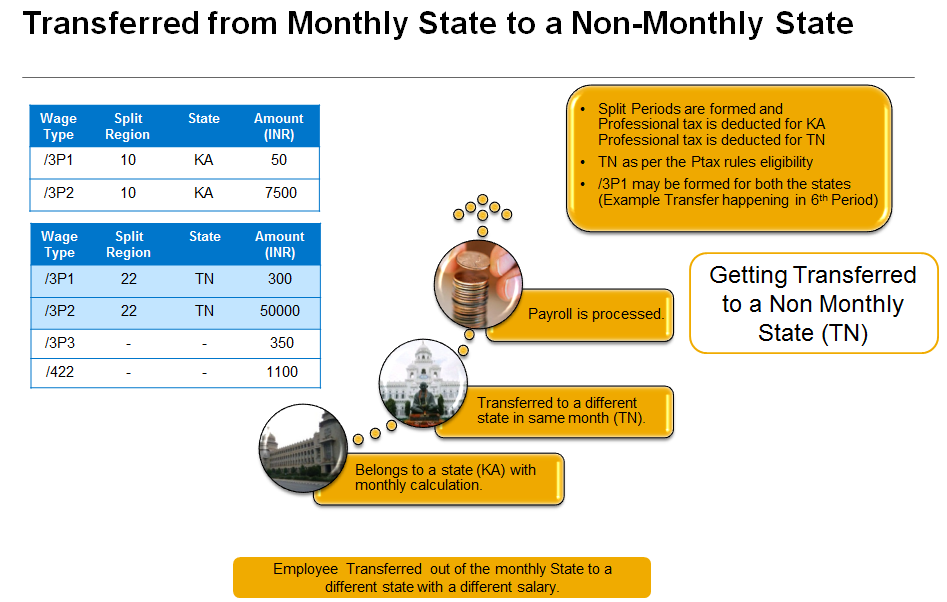

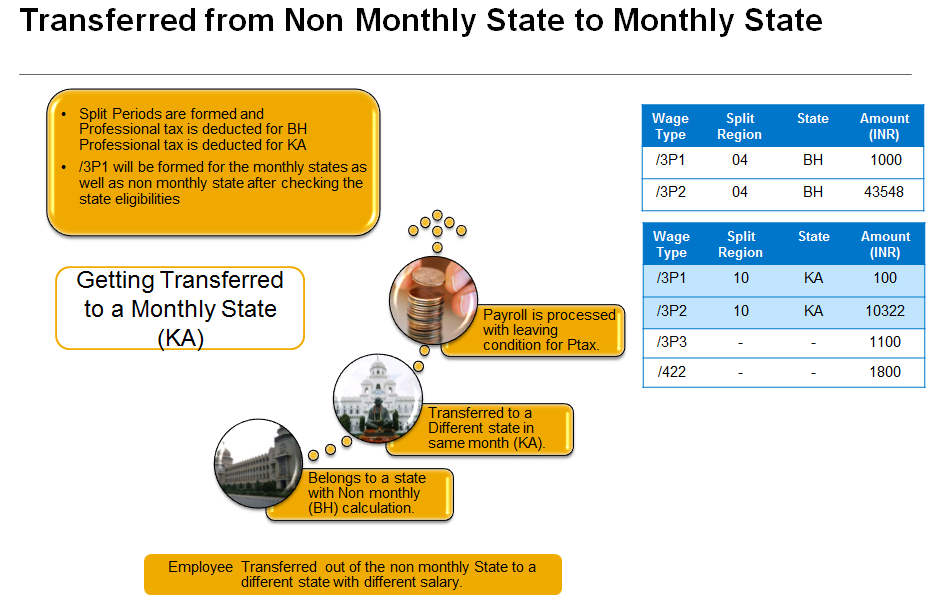

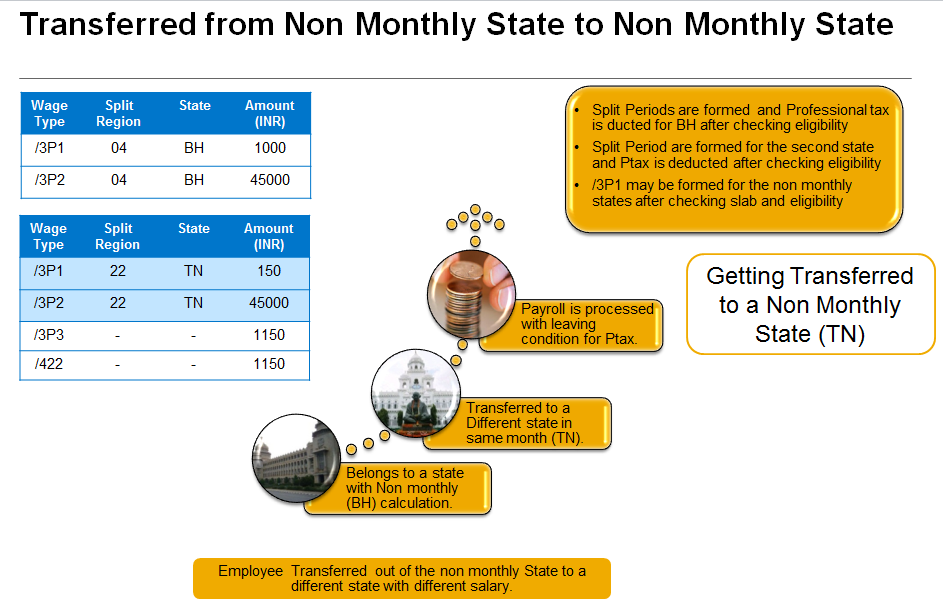

Transfer Scenarios Among States

-

Case 1:

-

Case 2:

-

Case 3:

-

Case 4:

-

Carry Forward Types and Basis Types

Region Carry Forward Type Basis Type AP02 Gross Carry Forward Due Basis BH01 Gross Carry Forward Due Basis GU01 Gross Carry Forward Due Basis KE01 Gross Carry Forward Due Basis MP01 Gross Carry Forward Nominal Basis MH01 Gross Carry Forward Due Basis MN01 Gross Carry Forward Due Basis OR03 Gross Carry Forward Due Basis RJ01 Gross Carry Forward Due Basis TN01 Gross Carry Forward Due Basis JH01 Gross Carry Forward Due Basis TNP1 Gross Carry Forward Due Basis TNP2 Gross Carry Forward Due Basis TNP3 Gross Carry Forward Due Basis TNP4 Gross Carry Forward Due Basis CA01 Gross Carry Forward Due Basis AS01 Deduction Carry Forward Due Basis TP01 Deduction Carry Forward Due Basis WB01 Deduction Carry Forward Due Basis CT01 Deduction Carry Forward Nominal Basis KA01 Deduction Carry Forward Due Basis MZ01 Deduction Carry Forward Due Basis NG01 Deduction Carry Forward Due Basis SK01 Deduction Carry Forward Due Basis

-

-

-

-

Vijayawada Region

| AP02 | 1 | 15.000,00 | 0,00 | INR |

| AP02 | 2 | 20.000,00 | 150,00 | INR |

| AP02 | 3 | 9.999.999,99 | 200,00 | INR |

Bihar

| BH01 | 1 | 299.999,00 | 0,00 | INR |

| BH01 | 2 | 499.999,00 | 1.000,00 | INR |

| BH01 | 3 | 999.999,00 | 2.000,00 | INR |

| BH01 | 4 | 9.999.999,00 | 2.500,00 | INR |

Ahmedabad Municipal

| GU01 | 1 | 2.999,99 | 0,00 | INR |

| GU01 | 2 | 5.999,99 | 20,00 | INR |

| GU01 | 3 | 8.999,99 | 40,00 | INR |

| GU01 | 4 | 11.999,99 | 60,00 | INR |

| GU01 | 5 | 9.999.999,99 | 80,00 | INR |

Cochin Corporation

| KE01 | 1 | 3.599,99 | 0,00 | |

| KE01 | 2 | 5.399,99 | 9,00 | INR |

| KE01 | 3 | 7.799,99 | 15,00 | INR |

| KE01 | 4 | 10.799,99 | 24,00 | INR |

| KE01 | 5 | 14.399,99 | 37,00 | INR |

| KE01 | 6 | 17.999,99 | 50,00 | INR |

| KE01 | 7 | 23.999,99 | 75,00 | INR |

| KE01 | 8 | 29.999,99 | 100,00 | INR |

| KE01 | 9 | 35.999,99 | 125,00 | INR |

| KE01 | 10 | 41.999,99 | 175,00 | INR |

| KE01 | 11 | 47.999,99 | 250,00 | INR |

| KE01 | 12 | 71.999,99 | 500,00 | INR |

| KE01 | 13 | 101.999,99 | 750,00 | INR |

| KE01 | 14 | 125.999,99 | 1.000,00 | INR |

| KE01 | 15 | 999.999,99 | 1.250,00 | INR |

Bhopal Region

| MP01 | 1 | 150.000,00 | 0,00 | INR |

| MP01 | 2 | 180.000,00 | 1.500,00 | INR |

| MP01 | 3 | 9.999.999,99 | 2.500,00 | INR |

Mumbai Mahanagar Nigam

| MH01 | 1 | 1.999,99 | 0,00 | INR |

| MH01 | 2 | 2.499,99 | 30,00 | INR |

| MH01 | 3 | 3.499,99 | 60,00 | INR |

| MH01 | 4 | 4.999,99 | 120,00 | INR |

| MH01 | 5 | 9.999,99 | 175,00 | INR |

| MH01 | 6 | 9.999.999,99 | 200,00 | INR |

Manipur

| MN01 | 1 | 50.000,00 | 0,00 | INR |

| MN01 | 2 | 75.000,00 | 1.200,00 | INR |

| MN01 | 3 | 100.000,00 | 2.000,00 | INR |

| MN01 | 4 | 125.000,00 | 2.400,00 | INR |

| MN01 | 5 | 9.999.999,99 | 2.500,00 | INR |

Odisha

| OR03 | 1 | 160.000,00 | 0,00 | INR |

| OR03 | 2 | 300.000,00 | 125,00 | INR |

| OR03 | 3 | 9.999.999,99 | 300,00 | INR |

Rajasthan

| RJ01 | 1 | 12.500,99 | 0,00 | INR |

| RJ01 | 2 | 16.500,99 | 100,00 | INR |

| RJ01 | 3 | 20.000,99 | 150,00 | INR |

| RJ01 | 4 | 9.999.999,99 | 200,00 | INR |

Old Slab for Chennai Corporation

| TN01 | 1 | 21.000,99 | 0,00 | INR |

| TN01 | 2 | 30.000,99 | 60,00 | INR |

| TN01 | 3 | 45.000,99 | 150,00 | INR |

| TN01 | 4 | 60.000,99 | 300,00 | INR |

| TN01 | 5 | 75.000,99 | 450,00 | INR |

| TN01 | 6 | 9.999.999,99 | 600,00 | INR |

New Slab for Chennai Corporation

| TN03 | 1 | 21.000,99 | 0,00 | INR |

| TN03 | 2 | 30.000,99 | 100 | INR |

| TN03 | 3 | 45.000,99 | 235 | INR |

| TN03 | 4 | 60.000,99 | 510 | INR |

| TN03 | 5 | 75.000,99 | 760 | INR |

| TN03 | 6 | 9.999.999,99 | 1095 | INR |

Jharkhand

| JH01 | 1 | 300.000,00 | 0,00 | INR |

| JH01 | 2 | 500.000,00 | 1.200,00 | INR |

| JH01 | 3 | 800.000,00 | 1.800,00 | INR |

| JH01 | 4 | 1.000.000,00 | 2.100,00 | INR |

| JH01 | 5 | 9.999.999,00 | 2.500,00 | INR |

Madurai Panchayat / Gummidipoondi Panchayat / Tirunelveli Panchayat / Meelavittan Panchayat

| TNP1 | 1 | 21.000,99 | 0,00 | INR |

| TNP1 | 2 | 30.000,99 | 60,00 | INR |

| TNP1 | 3 | 45.000,99 | 150,00 | INR |

| TNP1 | 4 | 60.000,99 | 300,00 | INR |

| TNP1 | 5 | 75.000,99 | 450,00 | INR |

| TNP1 | 6 | 9.999.999,99 | 600,00 | INR |

Kerala Panchayat

| CA01 | 1 | 11.999,00 | 0,00 | INR |

| CA01 | 2 | 17.999,00 | 120,00 | INR |

| CA01 | 3 | 29.999,00 | 180,00 | INR |

| CA01 | 4 | 44.999,00 | 300,00 | INR |

| CA01 | 5 | 59.999,00 | 450,00 | INR |

| CA01 | 6 | 74.999,00 | 600,00 | INR |

| CA01 | 7 | 99.999,00 | 750,00 | INR |

| CA01 | 8 | 124.999,00 | 1.000,00 | INR |

| CA01 | 9 | 9.999.999,00 | 1.250,00 | INR |

Assam

| AS01 | 1 | 3.499,99 | 0,00 | INR |

| AS01 | 2 | 3.999,99 | 50,00 | INR |

| AS01 | 3 | 4.999,99 | 65,00 | INR |

| AS01 | 4 | 5.999,99 | 80,00 | INR |

| AS01 | 5 | 6.999,99 | 95,00 | INR |

| AS01 | 6 | 7.999,99 | 110,00 | INR |

| AS01 | 7 | 8.999,99 | 125,00 | INR |

| AS01 | 8 | 9.999,99 | 140,00 | INR |

| AS01 | 9 | 11.499,99 | 155,00 | INR |

| AS01 | 10 | 12.999,99 | 175,00 | INR |

| AS01 | 11 | 14.999,99 | 195,00 | INR |

| AS01 | 12 | 9.999.999,99 | 205,00 | INR |

Tripura

| TP01 | 1 | 5.000,00 | 0,00 | INR |

| TP01 | 2 | 10.000,00 | 50,00 | INR |

| TP01 | 3 | 15.000,00 | 100,00 | INR |

| TP01 | 4 | 20.000,00 | 150,00 | INR |

| TP01 | 5 | 25.000,00 | 200,00 | INR |

| TP01 | 6 | 9.999.999,99 | 250,00 | INR |

Calcutta East

| WB01 | 1 | 1.500,99 | 0,00 | INR |

| WB01 | 2 | 2.000,99 | 18,00 | INR |

| WB01 | 3 | 3.000,99 | 25,00 | INR |

| WB01 | 4 | 5.000,99 | 30,00 | INR |

| WB01 | 5 | 6.000,99 | 40,00 | INR |

| WB01 | 6 | 7.000,99 | 45,00 | INR |

| WB01 | 7 | 8.000,99 | 50,00 | INR |

| WB01 | 8 | 9.000,99 | 90,00 | INR |

| WB01 | 9 | 15.000,99 | 110,00 | INR |

| WB01 | 10 | 25.000,99 | 130,00 | INR |

| WB01 | 11 | 40.000,99 | 150,00 | INR |

| WB01 | 12 | 9.999.999,99 | 200,00 | INR |

Chhattisgarh

| CT01 | 1 | 39.999,99 | 0,00 | INR |

| CT01 | 2 | 49.999,99 | 360,00 | INR |

| CT01 | 3 | 59.999,99 | 720,00 | INR |

| CT01 | 4 | 79.999,99 | 1.080,00 | INR |

| CT01 | 5 | 99.999,99 | 1.200,00 | INR |

| CT01 | 6 | 149.999,99 | 1.440,00 | INR |

| CT01 | 7 | 199.999,99 | 1.800,00 | INR |

| CT01 | 8 | 249.999,99 | 2.160,00 | INR |

| CT01 | 9 | 299.999,99 | 2.280,00 | INR |

| CT01 | 10 | 9.999.999,99 | 2.400,00 | INR |

Hosur Corporation

| KA01 | 1 | 2.999,99 | 0,00 | INR |

| KA01 | 2 | 4.999,99 | 25,00 | INR |

| KA01 | 3 | 7.999,99 | 50,00 | INR |

| KA01 | 4 | 9.999,99 | 75,00 | INR |

| KA01 | 5 | 14.999,99 | 100,00 | INR |

| KA01 | 6 | 19.999,99 | 150,00 | INR |

| KA01 | 7 | 9.999.999,99 | 200,00 | INR |

Mizoram

| MZ01 | 1 | 3.500,00 | 0,00 | INR |

| MZ01 | 2 | 5.000,00 | 24,00 | INR |

| MZ01 | 3 | 10.000,00 | 36,00 | INR |

| MZ01 | 4 | 15.000,00 | 50,00 | INR |

| MZ01 | 5 | 20.000,00 | 70,00 | INR |

| MZ01 | 6 | 25.000,00 | 100,00 | INR |

| MZ01 | 7 | 30.000,00 | 150,00 | INR |

| MZ01 | 8 | 35.000,00 | 200,00 | INR |

| MZ01 | 9 | 9.999.999,99 | 250,00 | INR |

Nagaland

| NG01 | 1 | 3.500,00 | 0,00 | INR |

| NG01 | 2 | 5.000,00 | 24,00 | INR |

| NG01 | 3 | 10.000,00 | 36,00 | INR |

| NG01 | 4 | 15.000,00 | 50,00 | INR |

| NG01 | 5 | 20.000,00 | 70,00 | INR |

| NG01 | 6 | 25.000,00 | 100,00 | INR |

| NG01 | 7 | 30.000,00 | 150,00 | INR |

| NG01 | 8 | 35.000,00 | 200,00 | INR |

| NG01 | 9 | 9.999.999,99 | 250,00 | INR |

Sikkim

| SK01 | 1 | 20.000,00 | 0,00 | INR |

| SK01 | 2 | 30.000,00 | 125,00 | INR |

| SK01 | 3 | 40.000,00 | 150,00 | INR |

| SK01 | 4 | 9.999999,99 | 200,00 | INR |

Note:

The calculation logic of GCF and DCF can not be altered for a state once gone live.

For non monthly states refund of Ptax is not allowed.

Region code can not be changed. (V_T7INRG)

Stop Refund (/ZPR ) user Exit : EXIT_HINCALC0_009

Rule INPC – Possible to create new additional WTs without modifying Rule

Model WT : MP00 Professional Tax

The following tables have been identified to store the state specific information. The framework of tables also establishes a link between the employee’s organizational assignment status and the characteristics applicable for the state/region.

Table View Description

T7INP1 V_T7INP1 Define professional tax groups

T7INP2 Professional tax grouping text

T7INP4 V_T7INP4 Define slabs for states

T7INP3 V_T7INP3 Associate slab rates to state/region

T596F T596F HR Subroutines

V_7IN0P_PTX Personnel area/subarea grouping for Professional Tax

Leave A Comment?

You must be logged in to post a comment.